Question 11

Invoices received from a source system need touse a specific account based on 30 different expense types.

However, if the invoice is from a certain supplier type, it needs to go to a default account regardless of the expense type.

What is the solution?

However, if the invoice is from a certain supplier type, it needs to go to a default account regardless of the expense type.

What is the solution?

Question 12

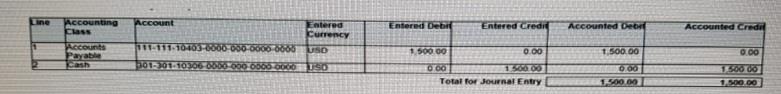

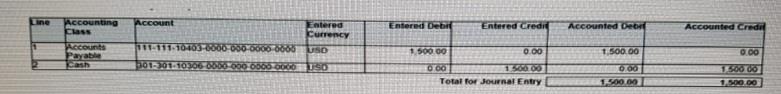

Given the subledger journal entry:

Note that the first segment is the primary balancing segment.

Which statement is True regarding this subledger journal entry?

Note that the first segment is the primary balancing segment.

Which statement is True regarding this subledger journal entry?

Question 13

Which three are mandatory transaction source information?

Question 14

Given the business use case:

'New Trucks' runs a fleet of trucks in a rental business In the U.S. The majority of the trucks are owned; however, in some cases, 'New Truck' may procure other trucks by renting them from third parties to their customers. When trucks are leased, the internal source code is 'L'. When trucks are owned, the internal source code is 'O'. This identifies different accounts used for the Journal entry. Customers sign a contract to initiate the truck rental for a specified duration period. The insurance fee is included in the contract and recognized over the rental period. For maintenance of the trucks, the "New Trucks* company has a subsidiary company

'Fix Trucks' that maintains its own profit andloss entity. To track all revenue, discounts, and maintenance expenses, 'New Trucks' needs to be able to view: total maintenance fee, total outstanding receivables, rental payment discounts, and total accrued and recognized insurance fee income.

How do you set up an account rule that is based on leased and owned trucks?

'New Trucks' runs a fleet of trucks in a rental business In the U.S. The majority of the trucks are owned; however, in some cases, 'New Truck' may procure other trucks by renting them from third parties to their customers. When trucks are leased, the internal source code is 'L'. When trucks are owned, the internal source code is 'O'. This identifies different accounts used for the Journal entry. Customers sign a contract to initiate the truck rental for a specified duration period. The insurance fee is included in the contract and recognized over the rental period. For maintenance of the trucks, the "New Trucks* company has a subsidiary company

'Fix Trucks' that maintains its own profit andloss entity. To track all revenue, discounts, and maintenance expenses, 'New Trucks' needs to be able to view: total maintenance fee, total outstanding receivables, rental payment discounts, and total accrued and recognized insurance fee income.

How do you set up an account rule that is based on leased and owned trucks?

Question 15

What is the duty role that needs to be assigned for authorizing accounting processing in Accounting Hub Cloud?