Question 126

A company's management accountant wishes to calculate the present value of the cost of renting a delivery vehicle. There will be five annual rental payments of $5,000, the first of which is due immediately. The company's discount rate is 12%.

Which TWO of the following are valid ways to calculate the present value of the rental payments?

Which TWO of the following are valid ways to calculate the present value of the rental payments?

Question 127

A company wishes to achieve a 20% return on the capital of $937,500 invested in the company. Total costs for the next period are budgeted to be $1,250,000.

The standard cost for product P is $11 per unit.

In order to achieve the required return on investment the selling price per unit of product P must be:

Give your answer to 2 decimal places.

The standard cost for product P is $11 per unit.

In order to achieve the required return on investment the selling price per unit of product P must be:

Give your answer to 2 decimal places.

Question 128

A company's cash budgetary plans show that there will be surplus cash for three months of the forthcoming year.

Which THREE of the following would be appropriate management actions in this situation?

Which THREE of the following would be appropriate management actions in this situation?

Question 129

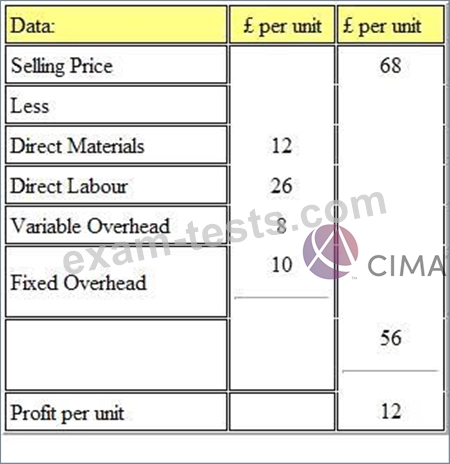

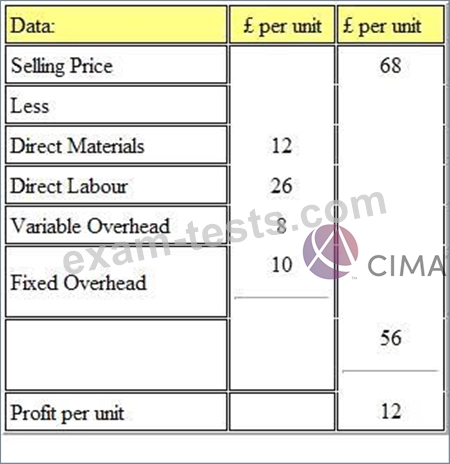

Refer to the exhibit.

A company manufactures and sells a single product which has the following cost and selling price structure:

The fixed overhead absorption rate was based on normal capacity of 1800 units per month.

The budgeted break-even point in sales units per month is units.

A company manufactures and sells a single product which has the following cost and selling price structure:

The fixed overhead absorption rate was based on normal capacity of 1800 units per month.

The budgeted break-even point in sales units per month is units.

Question 130

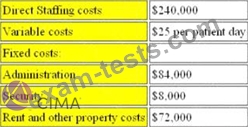

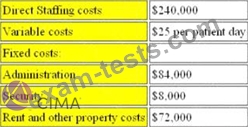

Refer to the exhibit.

X Enterprises runs a private nursing home for the elderly. The company are concerned that bed occupancy rates have been falling over the past 2 years with a consequential effect on profit. They have drawn up a budget for next year as follows:

The nursing home currently charges $90 per patient day.

The nursing home operates at 7,500 patient days per year. In an effort to increase occupancy rates the company are proposing to reduce the current price by 10% and increase spending on advertising by $10,000 each year. What effect will this have on the margin of safety?

X Enterprises runs a private nursing home for the elderly. The company are concerned that bed occupancy rates have been falling over the past 2 years with a consequential effect on profit. They have drawn up a budget for next year as follows:

The nursing home currently charges $90 per patient day.

The nursing home operates at 7,500 patient days per year. In an effort to increase occupancy rates the company are proposing to reduce the current price by 10% and increase spending on advertising by $10,000 each year. What effect will this have on the margin of safety?