Question 71

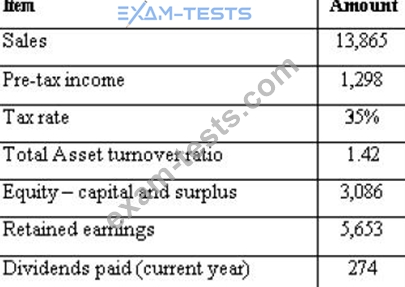

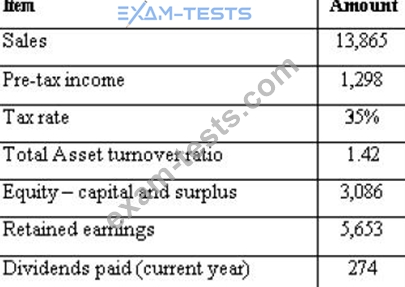

An analyst has extracted the following information from the financial statements of Myco:

What is the return on equity for Myco?

What is the return on equity for Myco?

Question 72

The marginal revenue product of a resource

Question 73

Which of the following statements is (are) true with respect to the price behavior of callable bonds and prepayable securities?

I). At very high levels of interest rates, the price of a callable bond will be very close to that of an equivalent non-callable bond.

II). At very low levels of interest rates, the call embedded in the bond will have a very low value.

III). Negative convexity will begin to appear for a callable bond at very low yield levels.

IV). At low yield levels, modified duration will overestimate the expected bond price for a given unit change in yield.

I). At very high levels of interest rates, the price of a callable bond will be very close to that of an equivalent non-callable bond.

II). At very low levels of interest rates, the call embedded in the bond will have a very low value.

III). Negative convexity will begin to appear for a callable bond at very low yield levels.

IV). At low yield levels, modified duration will overestimate the expected bond price for a given unit change in yield.

Question 74

The main difference between the current ratio and the quick ratio is that the quick ratio excludes:

Question 75

Jorgensen Products has just issued 25,000,000 in 4.50% annual coupon bonds at a market yield of

4 .80%. The bonds have a maturity of 8 years. What adjustments would an analyst make to the CFO at the end of the first year?

4 .80%. The bonds have a maturity of 8 years. What adjustments would an analyst make to the CFO at the end of the first year?