Question 41

Consider the following data: 1, 7, 3, 3, 6, 4 The mean and median for this data are:

Question 42

The relationship between the price of a callable bond, the price of an option-free bond and the price of the embedded call option is

Question 43

You can enter a derivative contract that will pay $100 at the end of a year if the price of corn exceeds

$ 3 per bushel, or $50 if it is equal to $3 per bushel or lower. The probability that corn will exceed $3 by the end of one year is 50%. The current price of the contract is $60, and interest is 5% per year. What is the optimal strategy?

$ 3 per bushel, or $50 if it is equal to $3 per bushel or lower. The probability that corn will exceed $3 by the end of one year is 50%. The current price of the contract is $60, and interest is 5% per year. What is the optimal strategy?

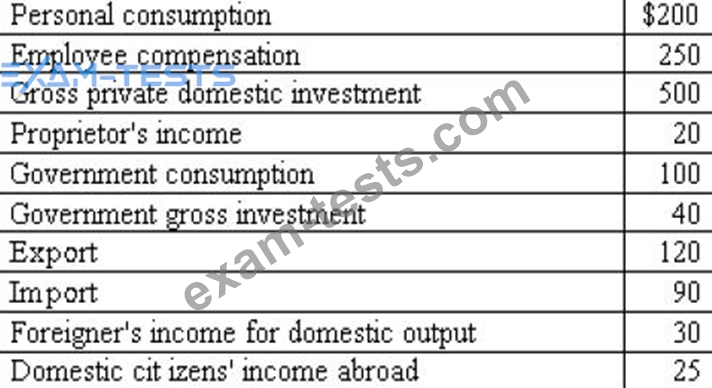

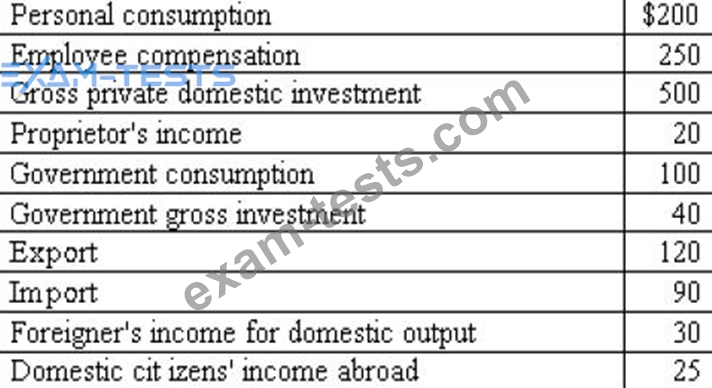

Question 44

What is the GDP in this example?

Question 45

Under the accelerated depreciation method,