Question 176

A portfolio has an expected rate of return of 15% and a standard deviation of 15%. The risk-free rate is 6 percent. An investor has the following utility function: U = E(r) - 0.5Ao2. Which value of A makes this investor indifferent between the risky portfolio and the risk-free asset?

Question 177

The price/earnings ratio valuation method values a company:

Question 178

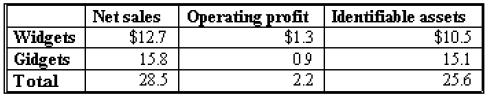

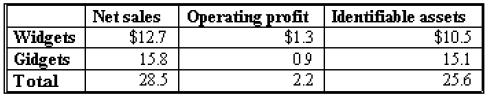

ABC Co. has the following segment reporting information for 1998.

Gidgets has a return on assets of:

Gidgets has a return on assets of:

Question 179

A 10-year, 8% coupon bond has a duration of 4.1 and a convexity measure of 168. If the yield on this bond was to decrease by 55 basis points, what would be the estimate of the bond's percentage price change?

Question 180

The Central Limit Theorem states that the sampling distribution of sample means is

I). normal, regardless of the sample size

II). normal, regardless of the population distribution

III). normal if the population is normal

IV). approximately normal if samples of size 30 or more are taken

I). normal, regardless of the sample size

II). normal, regardless of the population distribution

III). normal if the population is normal

IV). approximately normal if samples of size 30 or more are taken