Question 36

The government health service in country H employs well over 100,000 staff in various locations throughout the country. Traditionally, local management has had high levels of autonomy in relation to personnel issues and there are several different human resources (HR) managers located across various regions.

The government has decided to introduce a completely new HR/payroll information system to have just one database containing all relevant information about every staff member on the payroll (start date, job title, salary and all other details) and to use this information to begin streamlining recruitment and HR policies.

The government has outsourced the system's development to a reputable company.

Which of the following are disadvantages associated with this IT project?

The government has decided to introduce a completely new HR/payroll information system to have just one database containing all relevant information about every staff member on the payroll (start date, job title, salary and all other details) and to use this information to begin streamlining recruitment and HR policies.

The government has outsourced the system's development to a reputable company.

Which of the following are disadvantages associated with this IT project?

Question 37

D has decided to invest in a new factory at a cost of $6,000,000. The discount rate of the project is 22% and the PV of tax shield is $80,000.

What is the IRR?

Give your answer to two decimal places.

What is the IRR?

Give your answer to two decimal places.

Question 38

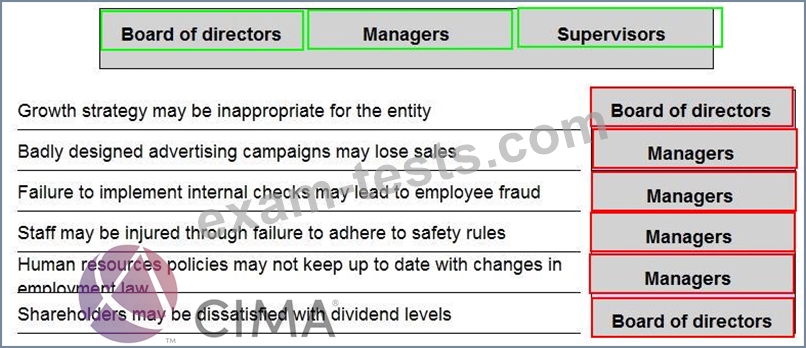

Select the most appropriate level of responsibility for managing each of the following risks.

Question 39

Which of the following are true of an effective risk management culture?

Question 40

RFG is considering a major expansion that will result in a more diversified business model.

At present, RFG's market capitalisation is $240 million. This is based on a beta of 1.6. The risk free rate is 4% and the market rate of return is 9%. RFG is financed entirely by equity. The company generates an annual cash surplus of $28.8 million.

The expansion will cost $50 million and will generate future cash flows of $12 million in perpetuity. This new business will reduce RFG's beta to 1.4.

Calculate the adjusted present value of the expansion.

At present, RFG's market capitalisation is $240 million. This is based on a beta of 1.6. The risk free rate is 4% and the market rate of return is 9%. RFG is financed entirely by equity. The company generates an annual cash surplus of $28.8 million.

The expansion will cost $50 million and will generate future cash flows of $12 million in perpetuity. This new business will reduce RFG's beta to 1.4.

Calculate the adjusted present value of the expansion.