Question 16

All of the following are limitations of teaming curve analysis except that

Question 17

Trans Action inc. (TAI) is a multidivisional supplier of power train components to the automobile industry.

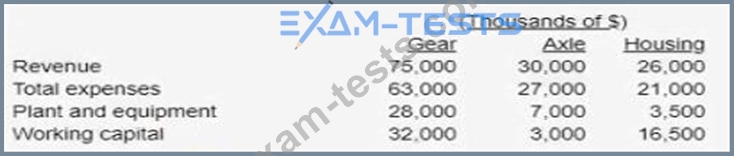

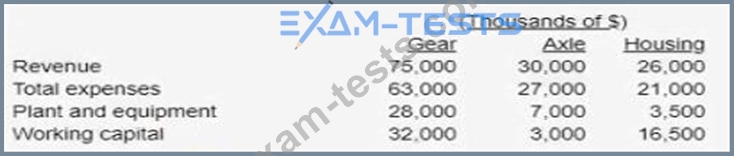

Following is selected information for the year just ended for each of the three divisions. Gear Axle and Housing.

The tai Board of Directors has decided to reward the employees or the divisions by allowing them to share in a bonus pool equal to S100.000 for each percentage point the return on investment (ROI) earned by their division exceeded the ROI of comparable firms as shown in the table below.

Rank the amounts in the bonus pools for the respective divisions from highest to lowest.

Following is selected information for the year just ended for each of the three divisions. Gear Axle and Housing.

The tai Board of Directors has decided to reward the employees or the divisions by allowing them to share in a bonus pool equal to S100.000 for each percentage point the return on investment (ROI) earned by their division exceeded the ROI of comparable firms as shown in the table below.

Rank the amounts in the bonus pools for the respective divisions from highest to lowest.

Question 18

Identify one external factor that provides opportunity for the Food-To-Go division.

Essay

Food Depot Ltd (FDD is a privately-held company that provides catering services to airlines and operates several restaurant chains including fast food, casual dining, and fine dining restaurants FDL has been profitable m recent years and has a very strong cash position FDL's newest division. Food-To-Go. is an online meal ordering and delivery platform acquired by FDL two years ago.

In 20X7. sales for the entire company were SI billion, with 50% of the business coming from the Airline Catering division. FDL is the country's leading airline catering services provider and controls 60% of the market share. However, the outlook of the airline catering industry is gloomy. The compound annual growth rate of the industry for the past five years was only 0.5% as airline networks have increasingly dropped catering on short domestic flights.

The Food-To-Go division only contributed 5% of FDL's total sales in 20X7 and is far behind in competing for market share of the online meal ordering and deliver, industry. It is estimated that Food-To-Go's sales were only 20% of the industry leader's sales However, the outlook for the online meal ordering and delivery services industry is bright. The compound annual growth rate of the industry since it started three years ago was 50%. It is estimated the rapid growth of the industry will continue in the foreseeable future.

The costs of shared corporate services are allocated based on each division s revenue FDL usually caps its capital expenditure budget to 4% of budgeted sales revenue In a recent capital budget coordination meeting.

Smith Whitney, the head of the Airline Catering division. complained that his division is underfunded on capital projects . The budgeted capital expenditure had been much less than 4 % of the division's budgeted sales in the past three years He argued that his division is the company's best-performing division, and it needs more funds to maintain its market share m the industry Whitney wants to reduce the capital expenditure budget for Food-To-Go and reallocate those funds to his division.

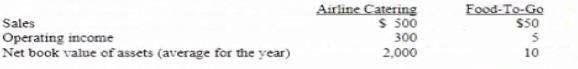

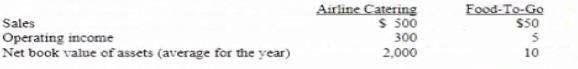

Susan Wiley, the bead of Food-To-Go, does not agree that the Airline Catering division is the best-performing division in the company Wiley argues that her division had the highest ROI in 20X7. and it deserves more capital funding FDL's required rate of return is 12%. The selected financial data for the Airline Catering division and Food-To-Go division in 20X7 are as follows (in $ millions).

Essay

Food Depot Ltd (FDD is a privately-held company that provides catering services to airlines and operates several restaurant chains including fast food, casual dining, and fine dining restaurants FDL has been profitable m recent years and has a very strong cash position FDL's newest division. Food-To-Go. is an online meal ordering and delivery platform acquired by FDL two years ago.

In 20X7. sales for the entire company were SI billion, with 50% of the business coming from the Airline Catering division. FDL is the country's leading airline catering services provider and controls 60% of the market share. However, the outlook of the airline catering industry is gloomy. The compound annual growth rate of the industry for the past five years was only 0.5% as airline networks have increasingly dropped catering on short domestic flights.

The Food-To-Go division only contributed 5% of FDL's total sales in 20X7 and is far behind in competing for market share of the online meal ordering and deliver, industry. It is estimated that Food-To-Go's sales were only 20% of the industry leader's sales However, the outlook for the online meal ordering and delivery services industry is bright. The compound annual growth rate of the industry since it started three years ago was 50%. It is estimated the rapid growth of the industry will continue in the foreseeable future.

The costs of shared corporate services are allocated based on each division s revenue FDL usually caps its capital expenditure budget to 4% of budgeted sales revenue In a recent capital budget coordination meeting.

Smith Whitney, the head of the Airline Catering division. complained that his division is underfunded on capital projects . The budgeted capital expenditure had been much less than 4 % of the division's budgeted sales in the past three years He argued that his division is the company's best-performing division, and it needs more funds to maintain its market share m the industry Whitney wants to reduce the capital expenditure budget for Food-To-Go and reallocate those funds to his division.

Susan Wiley, the bead of Food-To-Go, does not agree that the Airline Catering division is the best-performing division in the company Wiley argues that her division had the highest ROI in 20X7. and it deserves more capital funding FDL's required rate of return is 12%. The selected financial data for the Airline Catering division and Food-To-Go division in 20X7 are as follows (in $ millions).

Question 19

A company has the following accounts included in its trial balance as of December 31

What amount of equity will be reported on me company's balance sheet as of December 31?

What amount of equity will be reported on me company's balance sheet as of December 31?

Question 20

In trying to predict the returns on the stock market, a novice investor collected data on the sightings of sperm whales off the eastern coast of North America and the performance of the Dow Jones Industrial Average (the Dow) A regression of the two variables resulted in a correlation coefficient of -0.90 or a coefficient of determination (r2) of 81%. The sightings of whales seemed to be negatively correlated with the performance of the Dow. The novice investor should