Question 16

Safety Strollers was recently sued by several people who alleged harmful and unsafe strollers. The management team was largely unconcerned about these lawsuits due to the apparent negligence of the plaintiffs However, a consumer grassroots effort Drought these dangers into the public eye and the management team now fears for their brand s reputation and the sales o' their products. The facts are staring to get distorted and some stores are electing to no longer carry this brand. This situation could best be considered a

Question 17

Ryan Fitzgerald the vice president of finance for Southwest Development Company is evaluating a proposed expansion plan currently. Southwest Development has $660 million of total assets and the company's equity ratio Is 38% Southwest Development has never issued preferred shares. The company's earnings before interest and taxes (EBIT) are $83 6 million. The interest rate on their debt is 7 2% and the company's tax rate is 30%. The company is planning to expand by investing $110 million. In assets. As result both sales and EBIT will increase by 20%. The expansion will be financed with 40% debt and 60% common equity If Southwest Development proceeds with the expansion what will happen to the company's return on equally (ROE)?

Question 18

Essentials inc. operates two segments. Segment A and Segment B information about the revenues and costs for Essentials tot the previous year (by segment) is shown below The above analysis shows that Segment A is not profitable if Segment A is dropped, the revenues associated with the account will be lost and the related variable costs win be eliminated Also, the space freed by this product line will be rented for $40.000. The operating profit (loss) after dropping Segment A will be

Question 19

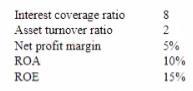

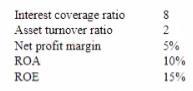

Explain now QDD's share repurchase plan would affect each of the following measures EPS, the degree of operating leverage, and the interest coverage ratio No calculations required Essay Quality Digital Design (QDD) Inc is a public-traded technology company Selected financial data of QDD for the prior year are as follows

QDD's stock was trading at $160 per share at the beginning of the yea: and at $176 per share by the end of the year. The company paid dividends of S5 per share. The company "s stock had a beta of 1 4 The stock market provided a total return of 12% last year, well above the 3% risk free rate of return QDD is considering the issuance of $200 million of bonds to fund the repurchase of $200 million of its stock.

QDD is evaluating the bond, including its term structure, maturity, and whether it should be callable obtaining the lowest coupon interest is an important objective of QDD. The CFO has estimated that sales for the current year would remain the same as last year and the new bond would add S12 million in annual interest payments

QDD's stock was trading at $160 per share at the beginning of the yea: and at $176 per share by the end of the year. The company paid dividends of S5 per share. The company "s stock had a beta of 1 4 The stock market provided a total return of 12% last year, well above the 3% risk free rate of return QDD is considering the issuance of $200 million of bonds to fund the repurchase of $200 million of its stock.

QDD is evaluating the bond, including its term structure, maturity, and whether it should be callable obtaining the lowest coupon interest is an important objective of QDD. The CFO has estimated that sales for the current year would remain the same as last year and the new bond would add S12 million in annual interest payments

Question 20

Using the dividend discount model, an analyst determines mat Beverly Company's equity is worth $80 per share. Beverly Company's required rate of return is 15% and the current risk-free rate is 5% assuming a 0% long-term growth rate, what is Beverly's estimated future annual dividend?