Question 261

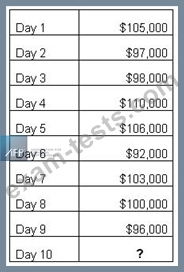

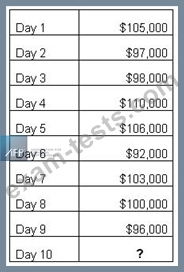

The treasury analyst for XYZ Corporation, a small retailer, is trying to forecast daily cash receipts being swept from the store depository accounts. The analyst has been given the data in the table regarding receipts from the last few days. The analyst chooses to use a seven-day simple moving average forecast methodology.

What is the amount that XYZ Corp. would expect to receive on Day 10 (rounded to the nearest whole $)?

What is the amount that XYZ Corp. would expect to receive on Day 10 (rounded to the nearest whole $)?

Question 262

Which of the following are interest-bearing instruments?

I) Certificates of deposit

II) Treasury bills

III) Treasury notes

IV) Banker's acceptances

I) Certificates of deposit

II) Treasury bills

III) Treasury notes

IV) Banker's acceptances

Question 263

Which of the following items would be classified as a source of cash on a company's statement of cash flow?

I. Selling, general, and administrative expense

II. Increase in accounts payable

III. Increase in inventory

IV.

Depreciation expense

I. Selling, general, and administrative expense

II. Increase in accounts payable

III. Increase in inventory

IV.

Depreciation expense

Question 264

A company has six fraudulent checks clear its primary disbursement account for a total of $7,652. The bank agrees to split the loss with the company to maintain a good relationship. As a condition of sharing the expense, the bank requires the company to establish positive pay on its disbursement accounts or have the company absorb the losses on future fraudulent payments.

What type of risk financing technique is the bank using?

What type of risk financing technique is the bank using?

Question 265

A company expects the U.S. dollar to depreciate in value compared to the British pound. The company will have a British pound payment to make in five months. The company would MOST LIKELY buy: