Question 16

Section B (2 Mark)

R acquired shares of G Ltd, on 15/12/1998 for Rs. 5 lakh which were sold on 15/5/2011 for Rs. 18.50 lakh.

Expenses of transfer were Rs. 20,000/-. He invests Rs. 6 lakh in the bonds of NHAI on 16/10/2011. Compute the capital gain for the assessment year 2012-13.

R acquired shares of G Ltd, on 15/12/1998 for Rs. 5 lakh which were sold on 15/5/2011 for Rs. 18.50 lakh.

Expenses of transfer were Rs. 20,000/-. He invests Rs. 6 lakh in the bonds of NHAI on 16/10/2011. Compute the capital gain for the assessment year 2012-13.

Question 17

Section A (1 Mark)

Guarantees covering security deposit/earnest money/advance payment/ mobilization advance etc. would come under__________________ category

Guarantees covering security deposit/earnest money/advance payment/ mobilization advance etc. would come under__________________ category

Question 18

Section A (1 Mark)

Which of the following income is not exempt under section 10-IT Act 1961?

Which of the following income is not exempt under section 10-IT Act 1961?

Question 19

Section A (1 Mark)

Nifty is a ..................

Nifty is a ..................

Question 20

Section C (4 Mark)

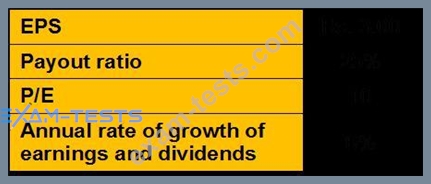

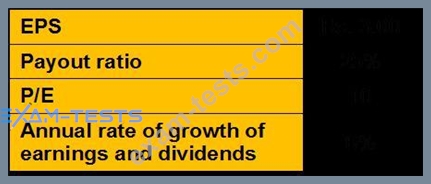

You know the following concerning a common stock:

If you want to earn 10 percent, should you buy this stock? What is the maximum price you should be willing to pay for the stock?

You know the following concerning a common stock:

If you want to earn 10 percent, should you buy this stock? What is the maximum price you should be willing to pay for the stock?