Question 96

R purchased a house property for Rs. 26,000 on 10-5-1962. He gets the first floor of the house constructed in

1967-68 by spending Rs. 40,000. He died on 12-9-1978. The property is transferred to Mrs. R by his will. Mrs.

R spends Rs. 30,000 and Rs. 26,700 during 1979-80 and 1985-86 respectively for renewals/reconstruction of the property. Mrs. R sells the house property for Rs. 11,50,000 on 15-3-2007, brokerage paid by Mrs. R is Rs.

11,500. The fair market value of the house on 1-4-1981 was Rs. 1,60,000. Find out the amount of capital gain chargeable to tax for the assessment year 2007-08.

1967-68 by spending Rs. 40,000. He died on 12-9-1978. The property is transferred to Mrs. R by his will. Mrs.

R spends Rs. 30,000 and Rs. 26,700 during 1979-80 and 1985-86 respectively for renewals/reconstruction of the property. Mrs. R sells the house property for Rs. 11,50,000 on 15-3-2007, brokerage paid by Mrs. R is Rs.

11,500. The fair market value of the house on 1-4-1981 was Rs. 1,60,000. Find out the amount of capital gain chargeable to tax for the assessment year 2007-08.

Question 97

A "Family Office" segment client has investible assets worth of

Question 98

For calculating portfolio risk, we need information for which of the following things?

Question 99

Which of the following statement is true?

Question 100

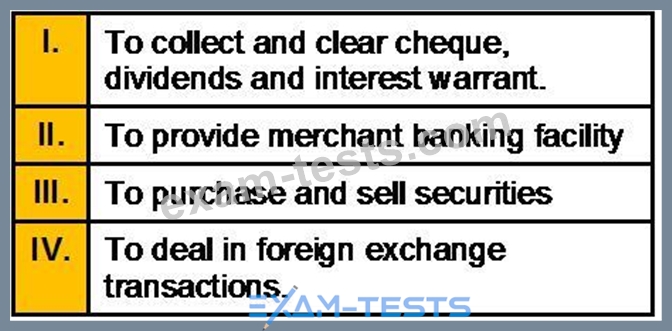

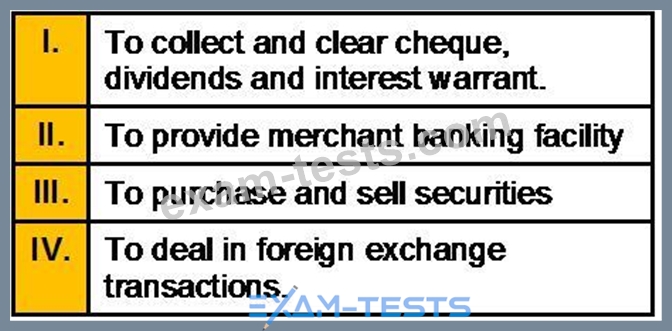

Which of the following are the agency functions of a Commercial Bank?