Question 176

A property has 120 rooms and each room has a monthly rent of Rs.750. The occupancy rate throughout the year is 80% and maintenance expenses per year works out to be Rs.3,00,000. Capitalization rate is 12%.

Calculate the value of the property?

Calculate the value of the property?

Question 177

Amount of liability of payment of gratuity is calculated at the rate of

Question 178

Mr. D'suza is a operations manager in a private company college in Hyderabad. During the previous year

2011-12, he gets the following emoluments:

He gets Rs. 17,500 as reimbursement from his employer in respect of medical expenditure incurred on treatment of his wife in a private clinic. Besides, he gets Rs.12, 300 as reimbursement from the employer in respect of books and journals purchased by him in discharging his official work.

He contributes 11% of his salary to statutory provident fund to which a matching contribution is made by the employer. During the year, he spends Rs.17, 000 for maintaining a car for going to the college. Determine his net income under the head salaries.

2011-12, he gets the following emoluments:

He gets Rs. 17,500 as reimbursement from his employer in respect of medical expenditure incurred on treatment of his wife in a private clinic. Besides, he gets Rs.12, 300 as reimbursement from the employer in respect of books and journals purchased by him in discharging his official work.

He contributes 11% of his salary to statutory provident fund to which a matching contribution is made by the employer. During the year, he spends Rs.17, 000 for maintaining a car for going to the college. Determine his net income under the head salaries.

Question 179

Often burdened with loan and generally both of the spouses work to earn their living. Under which category this type of family falls?

Question 180

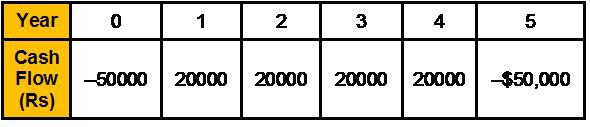

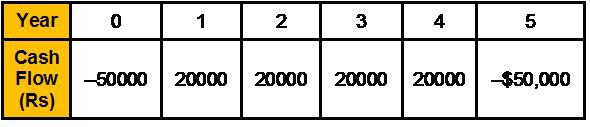

You are considering an investment with the following cash flows. Your required return is 8%, you generally require a payback of 3 years and a discounted payback of 4 years. If your objective is to maximize your wealth, should you take this investment?