Question 216

Which Provisions of the Transfer of Property Act defines 'lease' ?

Question 217

Sonia works at the post office. She deposits Rs. 1000 on every birthday into a retirement plan which paid an interest rate of 8% from the age of 20 years until she retired. If she had Rs. 260000 in her retirement plan when she retired, at what age did she retire?

Question 218

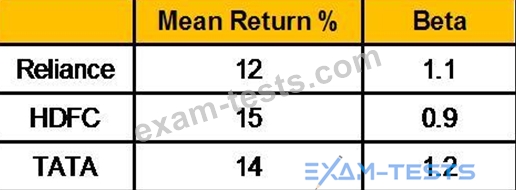

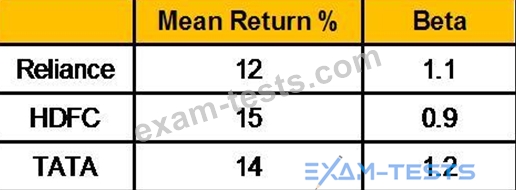

Consider the following information for three mutual funds

Risk free return is 7%. Calculate Treynor measure?

Risk free return is 7%. Calculate Treynor measure?

Question 219

Mr. Kadam is entitled to a salary of Rs. 25000 per month. He is given an option by his employer either to take house rent allowance or a rent free accommodation which is owned by the company. The HRA amount payable was Rs. 5000 per month. The rent for the hired accommodation was Rs. 6000 per month at New Delhi. Advice Mr. Kadam whether it would be beneficial for him to avail HRA or Rent Free Accommodation.

Give your advice on the basis of "Net Take Home Cash benefits".

Give your advice on the basis of "Net Take Home Cash benefits".

Question 220

Under a Personal Accident policy Mr. Ajay has taken, what percentage of sum assured he can get if he losses his one eye and one limb in an accident and under which type of benefit?