Question 286

Mr. Subhash Bansal, a marketing manager is employed with IMFB limited. He took an advance of Rs.

1,20,000 against the salary of Rs. 30,000 per month in the month of March 2007. The gross salary of Mr.

Adhikari for the assessment year 2007-08 shall be:

1,20,000 against the salary of Rs. 30,000 per month in the month of March 2007. The gross salary of Mr.

Adhikari for the assessment year 2007-08 shall be:

Question 287

Income from which trust is added to the beneficiary's taxable income?

Question 288

Mukesh a 35 years old man is a self employed businessman, engaged in the business of selling medical equipments and plans to retire from his business and hand it over to his children at age of 55, after which he wants to relax and enjoy his retired life. He is now earning around Rs. 4,00,000/- p.a. His life expectancy is another 15 years after retirement. After paying for his expenses he is able to save Rs. 85,000 /- p.a., and regularly invest it in a 6% p.a. investment plan.

Calculate what will be the Mukesh's total accumulation at his retirement? And if he wants to spend 4,00,000/- per year at beginning and dies at the age of 70 and assuming that he leaves behind Rs. 1,00,000/- as estate, what will be the short-fall in corpus?

Calculate what will be the Mukesh's total accumulation at his retirement? And if he wants to spend 4,00,000/- per year at beginning and dies at the age of 70 and assuming that he leaves behind Rs. 1,00,000/- as estate, what will be the short-fall in corpus?

Question 289

X, a shopkeeper says to Y, who manages his business - "Sell nothing to Z unless he pays you ready money, for I have no opinion of his honesty". Can Z claim against X for defamation?

Question 290

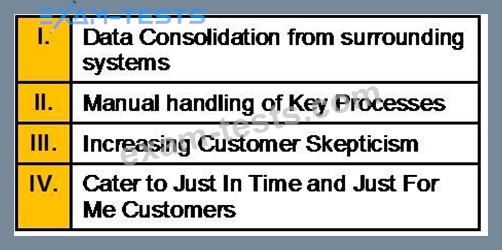

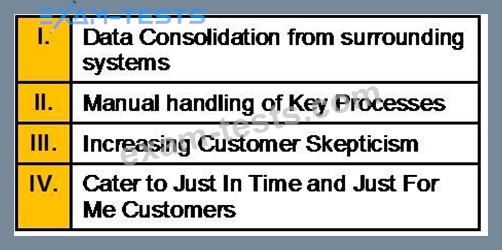

Which of the following is/are the challenges of Private Banking?