Question 21

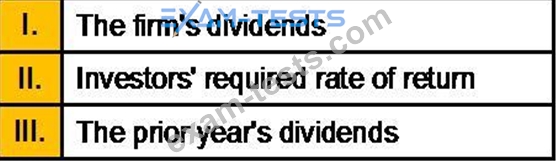

According to the dividend-growth model, the valuation of common stock depends on

Question 22

Sunil, aged 33 years, is having a policy of Rs. 1 Lac sum assured and is paying premium of Rs. 1,800/- for the last 10 years. The cash surrender value of this policy is at the end of previous year was Rs. 20,000. It is estimated that by this year end, the cash surrender value of this policy would be Rs. 22,900.

There is another term insurance of sum assured of Rs. 80,000 costs Rs. 300/- per annum which is available to him . If rate of interest is 6%, then first calculate the CPT of existing and new policy respectively and then advise Sunil if it is better to continue this policy or to discontinue it?

There is another term insurance of sum assured of Rs. 80,000 costs Rs. 300/- per annum which is available to him . If rate of interest is 6%, then first calculate the CPT of existing and new policy respectively and then advise Sunil if it is better to continue this policy or to discontinue it?

Question 23

Contribution under a defined benefit plan

Question 24

Mr. Bharat sees a stock with a beta of 1.2 selling for Rs. 25 and price will move up to Rs. 31 by the end of the year. The risk free rate is 6% and the expected market return is 15 %. In this scenario Mr. Bharat would like to know whether the stock is _____________ and so should ___________.

Question 25

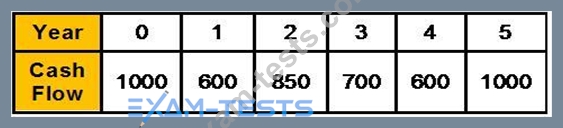

What is the present value of the following cash flows,if the Interest rate is 8%?