Question 316

X Ltd. has failed to remit the tax deducted at source from annual rent of Rs. 6,60,000 paid to Mr. A for its office building. The said rent is

Question 317

The income of any university or other educational institution existing solely for educational purposes and not for the purposes of profit is exempt under clause (iiiad) of Section 10(23C) if the aggregate annual receipts' of such univer*sity or educational institution do not exceed.

Question 318

If there is an expectation of large decline in interest rates, which of the following investments should you choose?

Question 319

If any expenditure is incurred by an Indian company wholly and exclusively for the purpose of amalgamation or demerger, the said expenditure is

Question 320

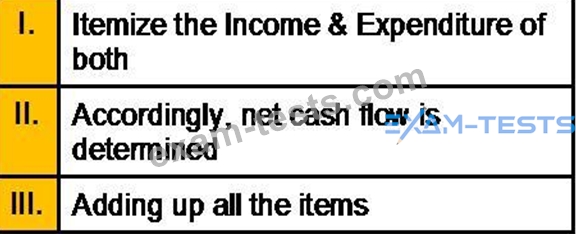

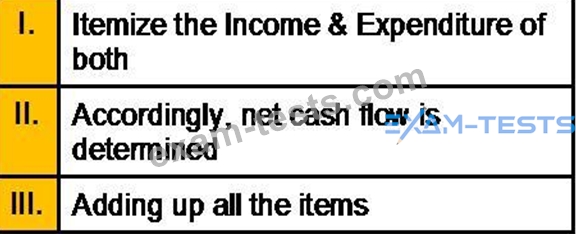

Determination of monthly income & expenditure of client & his spouse can be done with the following steps.

Arrange them in a logical order?

Arrange them in a logical order?