Question 106

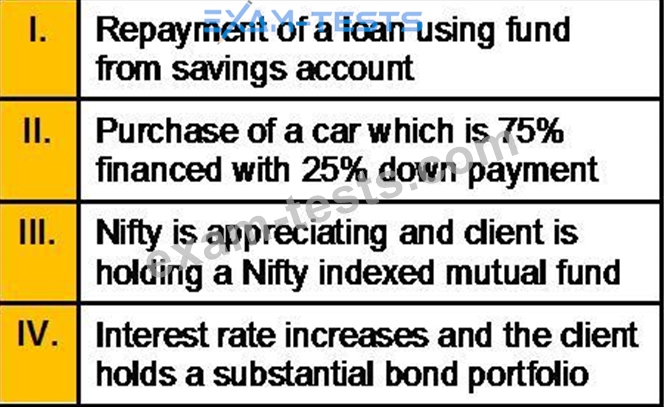

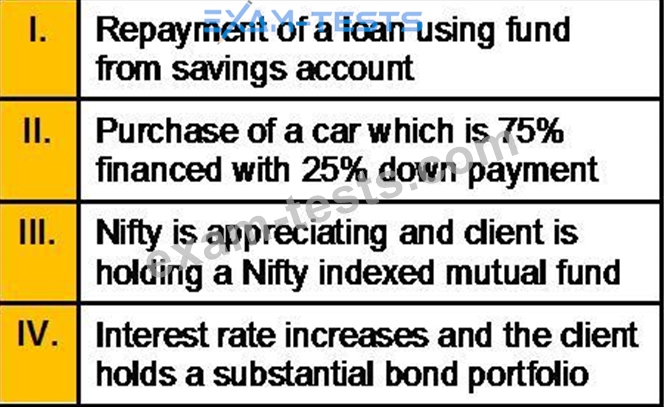

Which of the items would affect the net worth of the client?

Question 107

Accrued Interest on loan for self occupied property is Rs.110000 till 31 March 2010. Loan was taken for construction on 31/07/2006 and construction completed on 03/04/10. Interest for the year 2010-11 is Rs

22000. Determine what interest shall be allowed u/s 24(b) for AY 2011-12

22000. Determine what interest shall be allowed u/s 24(b) for AY 2011-12

Question 108

Mr. Sushil, is 35 years old and working as a physician in a private hospital. He will retire at the age of 60. He is saving Rs. 30,000/- p.a. at the end of every year for past 5 years and will continue to save the same up to his retirement @ 7% p.a. His annual expenditure is Rs. 3,00,000/-. Life expectancy of Mr. Sushil is 75 years. On retirement, rate of interest is expected to be 6%. Calculate on retirement how much he can spend per annum if he leaves Rs. 5,00,000/- as estate for next generation?

Question 109

Vishwajeet wishes to have a lump sum Retirement Fund of Rs. 25,00,000/- in 30 years time. Assuming that he can get 12% returns per annum, compounded annually, what amount he should save every year to reach his target?

Question 110

What will be the length of service of Sahil u/s 10(10) (ii) of the IT Act, 1961, if his difference between date of retirement and date of joining is as per detail given below ?