Question 236

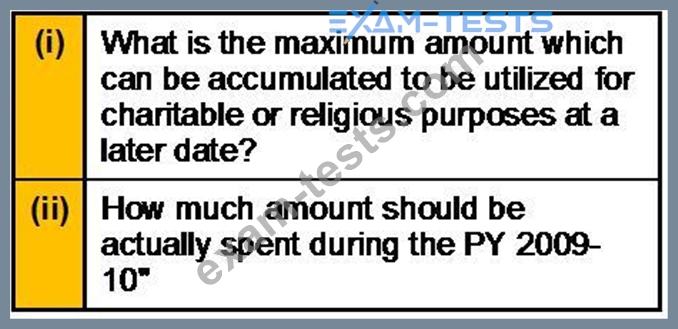

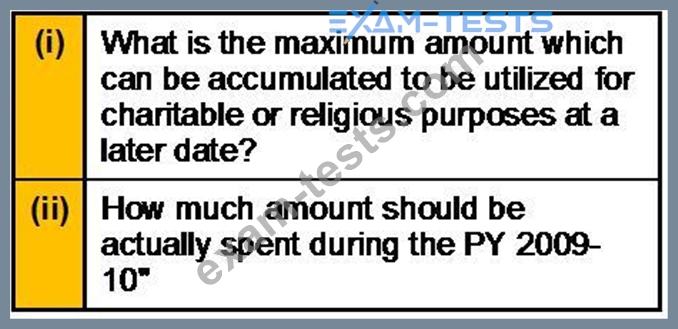

"During the PY 2009-10 a Poonawala Charitable Trust earned an income of Rs. 7 lakh out of which Rs.5 lakh was received during the PY 2009-10 and the balance Rs. 2 lakh was received during the PY 2011-2012.In order to claim full exemption of Rs. 7 lakh in the PY 2009-10:

Question 237

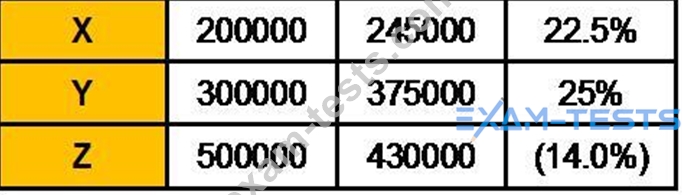

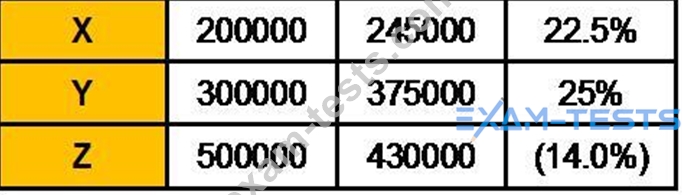

You own 3 scripts with their market value at Start of year end of year (3rd) total growth.

Calculate the CAGR of portfolio.

Calculate the CAGR of portfolio.

Question 238

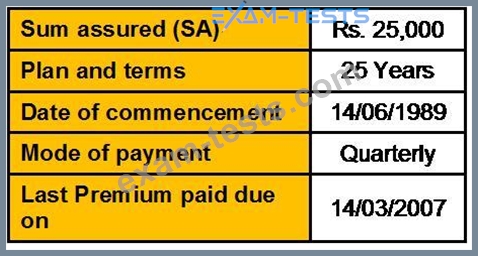

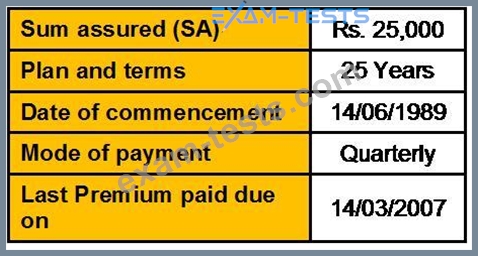

Calculate the Paid up Value ( PV) under a policy with the following particulars:

Consolidated Reversionary Bonus declared by the insurer from March, 1990 to March 2006 is 550/- per thousand sum assured. Bonus declared for the year ending March 2007 is @ Rs. 70/- per thousand.

Consolidated Reversionary Bonus declared by the insurer from March, 1990 to March 2006 is 550/- per thousand sum assured. Bonus declared for the year ending March 2007 is @ Rs. 70/- per thousand.

Question 239

Difference between coparceners & member is that coparcener can demand partition of an HUF

Question 240

An employee joined in the year 2000 in a sugar mill. After working all the years as a seasonal employee up to the year 2011. He retires with the following monthly salary Basic Salary 2000 / DA 1000/ HRA 500. How much gratuity is payable to him?