Question 266

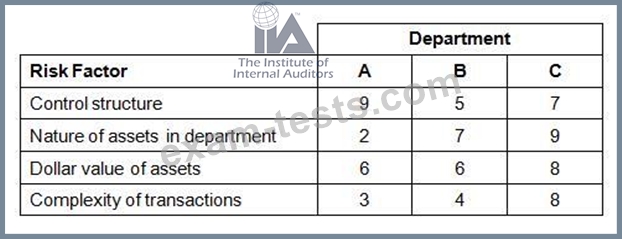

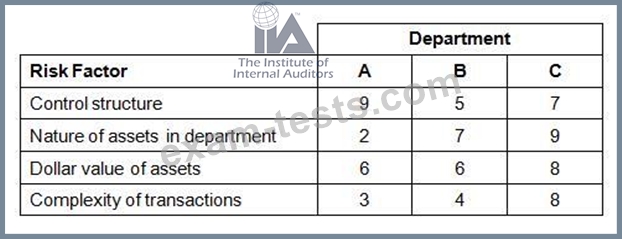

A bank uses a risk analysis matrix to quantify the relative risk of auditable entities. The analysis involves rating auditable entities on risk factors using a scale of 1 to 10, with 10 representing the greatest risk. A partial list of risk factors and the ratings given to three of the bank's departments is provided below:

Which of the following statements regarding risk in the department is true?

Which of the following statements regarding risk in the department is true?

Question 267

A chief audit executive (CAE) of a major retailer has engaged an independent firm of information security specialists to perform specialized internal audit activities. The CAE can rely on the specialists' work only if it is:

Question 268

According to the Standards, which of the following would least likely be considered a red flag when evaluating the risk for fraud?

Question 269

Which of the following is not a reason for an internal auditor to prepare an audit plan before the detailed audit work begins?

Question 270

An auditor evaluating excessive product rejection rates should investigatE.

I.

Communication between sales and production departments on sales returns.

II.

Volume of product sales year-to-date in comparison to prior year-to-date.

III.

Changes in credit ratings of customers versus sales to those customers.

IV.

Detailed product scrap accounts and accumulations.

I.

Communication between sales and production departments on sales returns.

II.

Volume of product sales year-to-date in comparison to prior year-to-date.

III.

Changes in credit ratings of customers versus sales to those customers.

IV.

Detailed product scrap accounts and accumulations.