Question 151

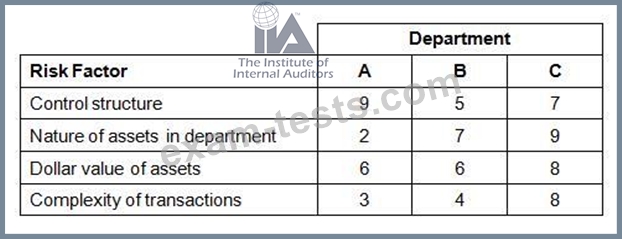

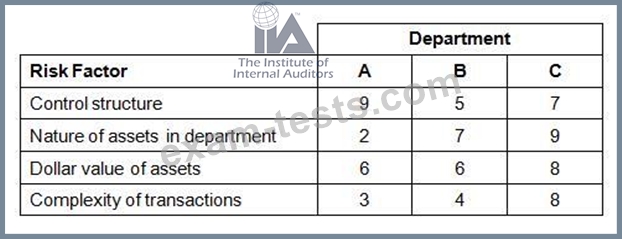

A bank uses a risk analysis matrix to quantify the relative risk of auditable entities. The analysis involves rating auditable entities on risk factors using a scale of 1 to 10, with 10 representing the greatest risk. A partial list of risk factors and the ratings given to three of the bank's departments is provided below:

Which of the following statements regarding risk in the department is true?

Which of the following statements regarding risk in the department is true?

Question 152

Because of an abundance of high priority requests from management, an internal audit activity no longer has the resources to meet all of its commitments contained in the annual audit plan. Which of the following would be the best course of action for the chief audit executive to follow?

Question 153

While performing a follow-up of a concern about equipment-inventory tracking, which course of action is not necessary for the auditor to take?

Question 154

When interviewing an individual in relation to a fraud investigation, which course of action should the internal auditor follow?

Question 155

In a client satisfaction survey for an internal audit engagement, client management should be asked to assess which of the following factors?

I. Audit team's knowledge of the audited area.

II. Usefulness of the audit results.

III. Quality of management of the internal audit activity.

IV.

Clarity of the scope and objectives of the audit engagement.

I. Audit team's knowledge of the audited area.

II. Usefulness of the audit results.

III. Quality of management of the internal audit activity.

IV.

Clarity of the scope and objectives of the audit engagement.