- Home

- CIPS Certification

- L5M4 Exam

- CIPS.L5M4.v2025-09-29.q14 Practice Test

Question 11

How could an organisation approach conducting an Industry Analysis? Describe the areas which would be useful to analyse. (25 marks)

Correct Answer:

See the answer in Explanation below:

Explanation:

Conducting an industry analysis is a strategic process that helps an organization understand the external environment in which it operates, enabling better decision-making in procurement, contract management, and supplier relationships. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, industry analysis supports strategic sourcing and risk management by identifying opportunities and threats that impact financial and operational outcomes. Below is a detailed step-by-step approach to conducting an industry analysis, followed by key areas to analyze.

Approach to Conducting an Industry Analysis:

* Define the Industry Scope:

* Clearly identify the industry or market segment relevant to the organization's operations (e.g., raw materials for manufacturing).

* Example: For XYZ Ltd (Question 7), the focus might be the steel industry for raw materials.

* Gather Data from Multiple Sources:

* Use primary sources (e.g., supplier interviews, industry reports) and secondary sources (e.g., market research, government data) to collect information.

* Example: Reviewing trade publications likeSteel Times Internationalfor market trends.

* Apply Analytical Frameworks:

* Use tools like Porter's Five Forces (Question 12) or PESTLE analysis to structure the evaluation of competitive and external factors.

* Example: Using Porter's Five Forces to assess supplier power in the steel industry.

* Analyze Trends and Patterns:

* Identify historical and emerging trends (e.g., price volatility, technological advancements) to predict future market dynamics.

* Example: Noting a trend toward sustainable steel production.

* Engage Stakeholders:

* Involve internal teams (e.g., procurement, finance) and external partners (e.g., suppliers) to validate findings and gain insights.

* Example: Discussing supply chain risks with key steel suppliers.

* Synthesize Findings and Develop Strategies:

* Compile the analysis into actionable insights to inform sourcing strategies, contract terms, and risk mitigation plans.

* Example: Deciding to diversify suppliers due to high supplier power in the industry.

Areas to Analyze:

* Market Structure and Competition:

* Assess the competitive landscape using Porter's Five Forces, focusing on rivalry,supplier/buyer power, new entrants, and substitutes.

* Why Useful: Helps understand competitive pressures that affect pricing and supplier negotiations.

* Example: High rivalry in the steel industry might drive down prices but increase innovation demands on suppliers.

* Market Trends and Growth Potential:

* Examine industry growth rates, demand trends, and emerging opportunities or threats (e.g., shifts to green technology).

* Why Useful: Identifies opportunities for cost savings or risks like supply shortages.

* Example: Rising demand for recycled steel could increase prices, impacting XYZ Ltd's costs.

* Regulatory and Legal Environment:

* Analyze regulations, trade policies, and compliance requirements affecting the industry (e.g., environmental laws, import tariffs).

* Why Useful: Ensures sourcing decisions align with legal standards, avoiding fines or disruptions.

* Example: Stricter carbon emission laws might require sourcing from eco-friendly steel suppliers.

* Technological Developments:

* Investigate innovations, automation, or digitalization trends that could impact supply chains or supplier capabilities.

* Why Useful: Highlights opportunities to leverage technology for efficiency or risks of obsolescence.

* Example: Adoption of AI in steel production might improve supplier efficiency but require new contract terms for quality assurance.

* Economic and Financial Factors:

* Evaluate economic conditions (e.g., inflation, currency fluctuations) and financial stability of the industry (e.g., profitability trends).

* Why Useful: Informs cost projections and risk assessments for contract planning.

* Example: Inflation-driven steel price increases might necessitate flexible pricing clauses in contracts.

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide emphasizes industry analysis as a critical step in "understanding the external environment" to inform procurement strategies and contract management. It is discussed in the context of market analysis and risk management, aligning with the module' s focus on achieving value for money and mitigating supply chain risks. The guide does not provide a step-by- step process but highlights tools like Porter's Five Forces and PESTLE, which are integrated into the approach above, and identifies key areas of focus that impact financial and operational outcomes.

* Approach to Conducting Industry Analysis:

* The guide stresses the importance of "systematic market analysis" to support strategic sourcing (Question 11) and supplier selection (Question 7). Steps like defining the scope, gathering data, and using frameworks like Porter's Five Forces are derived from its emphasis on structured evaluation.

* Data Gathering: Chapter 2 advises using "multiple data sources" (e.g., industry reports, supplier feedback) to ensure a comprehensive view, reducing the risk of biased decisions.

* Stakeholder Engagement: The guide highlights "collaboration with stakeholders" to validate market insights, ensuring procurement strategies are practical and aligned with organizational needs.

* Actionable Insights: L5M4's focus on translating analysis into "strategic decisions" supports the final step of developing sourcing or contract strategies based onfindings.

* Areas to Analyze:

* Market Structure and Competition:

* The guide explicitly references Porter's Five Forces (Question 12) as a tool to "assess competitive dynamics." Understanding rivalry or supplier power helps buyers negotiate better terms, ensuring cost efficiency-a core L5M4 principle.

* Market Trends and Growth Potential:

* Chapter 2 notes that "market trends impact supply availability and pricing." For XYZ Ltd, analyzing steel demand trends ensures they anticipate cost increases and secure supply, aligning with financial planning.

* Regulatory and Legal Environment:

* The guide's risk management section emphasizes "compliance with external regulations." Industry analysis must consider laws like environmental standards, which could limit supplier options or increase costs, requiring contract adjustments.

* Technological Developments:

* L5M4 highlights "technology as a driver of efficiency" in supply chains. Analyzing tech trends ensures buyers select suppliers capable of meeting future needs, supporting long- term value.

* Economic and Financial Factors:

* The guide stresses that "economic conditions affect cost structures." Inflation or currency fluctuations can impact supplier pricing, necessitating flexible contract terms to manage financial risks.

* Practical Application for XYZ Ltd:

* Approach: XYZ Ltd defines the steel industry as their focus, gathers data from trade reports and supplier discussions, applies Porter's Five Forces, analyzes trends (e.g., rising steel prices), engages their procurement team, and decides to negotiate long-term contracts to lock in prices.

* Areas: They assess high supplier power (Market Structure), rising demand for sustainable steel (Trends), new carbon regulations (Regulatory), automation in steel production (Technology), and inflation pressures (Economic), ensuring their sourcing strategy mitigates risks and controls costs.

* Broader Implications:

* The guide advises conducting industry analysis regularly, as markets are dynamic-e.g., new regulations or technologies can shift supplier dynamics.

* Financially, this analysis ensures cost control by anticipating price changes or disruptions, aligning with L5M4's focus on value for money. It also supports risk management by identifying threats like regulatory non-compliance or supplier instability.

Explanation:

Conducting an industry analysis is a strategic process that helps an organization understand the external environment in which it operates, enabling better decision-making in procurement, contract management, and supplier relationships. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, industry analysis supports strategic sourcing and risk management by identifying opportunities and threats that impact financial and operational outcomes. Below is a detailed step-by-step approach to conducting an industry analysis, followed by key areas to analyze.

Approach to Conducting an Industry Analysis:

* Define the Industry Scope:

* Clearly identify the industry or market segment relevant to the organization's operations (e.g., raw materials for manufacturing).

* Example: For XYZ Ltd (Question 7), the focus might be the steel industry for raw materials.

* Gather Data from Multiple Sources:

* Use primary sources (e.g., supplier interviews, industry reports) and secondary sources (e.g., market research, government data) to collect information.

* Example: Reviewing trade publications likeSteel Times Internationalfor market trends.

* Apply Analytical Frameworks:

* Use tools like Porter's Five Forces (Question 12) or PESTLE analysis to structure the evaluation of competitive and external factors.

* Example: Using Porter's Five Forces to assess supplier power in the steel industry.

* Analyze Trends and Patterns:

* Identify historical and emerging trends (e.g., price volatility, technological advancements) to predict future market dynamics.

* Example: Noting a trend toward sustainable steel production.

* Engage Stakeholders:

* Involve internal teams (e.g., procurement, finance) and external partners (e.g., suppliers) to validate findings and gain insights.

* Example: Discussing supply chain risks with key steel suppliers.

* Synthesize Findings and Develop Strategies:

* Compile the analysis into actionable insights to inform sourcing strategies, contract terms, and risk mitigation plans.

* Example: Deciding to diversify suppliers due to high supplier power in the industry.

Areas to Analyze:

* Market Structure and Competition:

* Assess the competitive landscape using Porter's Five Forces, focusing on rivalry,supplier/buyer power, new entrants, and substitutes.

* Why Useful: Helps understand competitive pressures that affect pricing and supplier negotiations.

* Example: High rivalry in the steel industry might drive down prices but increase innovation demands on suppliers.

* Market Trends and Growth Potential:

* Examine industry growth rates, demand trends, and emerging opportunities or threats (e.g., shifts to green technology).

* Why Useful: Identifies opportunities for cost savings or risks like supply shortages.

* Example: Rising demand for recycled steel could increase prices, impacting XYZ Ltd's costs.

* Regulatory and Legal Environment:

* Analyze regulations, trade policies, and compliance requirements affecting the industry (e.g., environmental laws, import tariffs).

* Why Useful: Ensures sourcing decisions align with legal standards, avoiding fines or disruptions.

* Example: Stricter carbon emission laws might require sourcing from eco-friendly steel suppliers.

* Technological Developments:

* Investigate innovations, automation, or digitalization trends that could impact supply chains or supplier capabilities.

* Why Useful: Highlights opportunities to leverage technology for efficiency or risks of obsolescence.

* Example: Adoption of AI in steel production might improve supplier efficiency but require new contract terms for quality assurance.

* Economic and Financial Factors:

* Evaluate economic conditions (e.g., inflation, currency fluctuations) and financial stability of the industry (e.g., profitability trends).

* Why Useful: Informs cost projections and risk assessments for contract planning.

* Example: Inflation-driven steel price increases might necessitate flexible pricing clauses in contracts.

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide emphasizes industry analysis as a critical step in "understanding the external environment" to inform procurement strategies and contract management. It is discussed in the context of market analysis and risk management, aligning with the module' s focus on achieving value for money and mitigating supply chain risks. The guide does not provide a step-by- step process but highlights tools like Porter's Five Forces and PESTLE, which are integrated into the approach above, and identifies key areas of focus that impact financial and operational outcomes.

* Approach to Conducting Industry Analysis:

* The guide stresses the importance of "systematic market analysis" to support strategic sourcing (Question 11) and supplier selection (Question 7). Steps like defining the scope, gathering data, and using frameworks like Porter's Five Forces are derived from its emphasis on structured evaluation.

* Data Gathering: Chapter 2 advises using "multiple data sources" (e.g., industry reports, supplier feedback) to ensure a comprehensive view, reducing the risk of biased decisions.

* Stakeholder Engagement: The guide highlights "collaboration with stakeholders" to validate market insights, ensuring procurement strategies are practical and aligned with organizational needs.

* Actionable Insights: L5M4's focus on translating analysis into "strategic decisions" supports the final step of developing sourcing or contract strategies based onfindings.

* Areas to Analyze:

* Market Structure and Competition:

* The guide explicitly references Porter's Five Forces (Question 12) as a tool to "assess competitive dynamics." Understanding rivalry or supplier power helps buyers negotiate better terms, ensuring cost efficiency-a core L5M4 principle.

* Market Trends and Growth Potential:

* Chapter 2 notes that "market trends impact supply availability and pricing." For XYZ Ltd, analyzing steel demand trends ensures they anticipate cost increases and secure supply, aligning with financial planning.

* Regulatory and Legal Environment:

* The guide's risk management section emphasizes "compliance with external regulations." Industry analysis must consider laws like environmental standards, which could limit supplier options or increase costs, requiring contract adjustments.

* Technological Developments:

* L5M4 highlights "technology as a driver of efficiency" in supply chains. Analyzing tech trends ensures buyers select suppliers capable of meeting future needs, supporting long- term value.

* Economic and Financial Factors:

* The guide stresses that "economic conditions affect cost structures." Inflation or currency fluctuations can impact supplier pricing, necessitating flexible contract terms to manage financial risks.

* Practical Application for XYZ Ltd:

* Approach: XYZ Ltd defines the steel industry as their focus, gathers data from trade reports and supplier discussions, applies Porter's Five Forces, analyzes trends (e.g., rising steel prices), engages their procurement team, and decides to negotiate long-term contracts to lock in prices.

* Areas: They assess high supplier power (Market Structure), rising demand for sustainable steel (Trends), new carbon regulations (Regulatory), automation in steel production (Technology), and inflation pressures (Economic), ensuring their sourcing strategy mitigates risks and controls costs.

* Broader Implications:

* The guide advises conducting industry analysis regularly, as markets are dynamic-e.g., new regulations or technologies can shift supplier dynamics.

* Financially, this analysis ensures cost control by anticipating price changes or disruptions, aligning with L5M4's focus on value for money. It also supports risk management by identifying threats like regulatory non-compliance or supplier instability.

Question 12

Describe the SERVQUAL model that can be used to assess quality in the service industry (15 points). What are the advantages of using the model? (10 points)

Correct Answer:

See the answer in Explanation below:

Explanation:

* Part 1: Description of the SERVQUAL Model (15 points)

* Step 1: Define the ModelSERVQUAL is a framework to measure service quality by comparing customerexpectations with their perceptions of actual service received.

* Step 2: Key ComponentsIt uses five dimensions to assess quality:

* Tangibles:Physical aspects (e.g., facilities, equipment, staff appearance).

* Reliability:Delivering promised services dependably and accurately.

* Responsiveness:Willingness to help customers and provide prompt service.

* Assurance:Knowledge and courtesy of staff, inspiring trust.

* Empathy:Caring, individualized attention to customers.

* Step 3: ApplicationCustomers rate expectations and perceptions on a scale (e.g., 1-7), and gaps between the two highlight areas for improvement.

* Outcome:Identifies service quality deficiencies for targeted enhancements.

* Part 2: Advantages of Using the SERVQUAL Model (10 points)

* Step 1: Customer-Centric InsightFocuses on customer perceptions, aligning services with their needs.

* Step 2: Gap IdentificationPinpoints specific weaknesses (e.g., low responsiveness), enabling precise action.

* Step 3: BenchmarkingAllows comparison over time or against competitors to track progress.

* Outcome:Enhances service delivery and competitiveness in the service industry.

Exact Extract Explanation:

* SERVQUAL Description:The CIPS L5M4 Study Guide notes, "SERVQUAL assesses service quality through five dimensions-tangibles, reliability, responsiveness, assurance, and empathy-by measuring gaps between expectation and performance" (CIPS L5M4 Study Guide, Chapter 2, Section 2.5).

* Advantages:It states, "The model's strengths include its focus on customer perspectives, ability to identify service gaps, and utility as a benchmarking tool" (CIPS L5M4 Study Guide, Chapter 2, Section

2.5).This is vital for service-based procurement and contract management. References: CIPS L5M4 Study Guide, Chapter 2: Supply Chain Performance Management.

Explanation:

* Part 1: Description of the SERVQUAL Model (15 points)

* Step 1: Define the ModelSERVQUAL is a framework to measure service quality by comparing customerexpectations with their perceptions of actual service received.

* Step 2: Key ComponentsIt uses five dimensions to assess quality:

* Tangibles:Physical aspects (e.g., facilities, equipment, staff appearance).

* Reliability:Delivering promised services dependably and accurately.

* Responsiveness:Willingness to help customers and provide prompt service.

* Assurance:Knowledge and courtesy of staff, inspiring trust.

* Empathy:Caring, individualized attention to customers.

* Step 3: ApplicationCustomers rate expectations and perceptions on a scale (e.g., 1-7), and gaps between the two highlight areas for improvement.

* Outcome:Identifies service quality deficiencies for targeted enhancements.

* Part 2: Advantages of Using the SERVQUAL Model (10 points)

* Step 1: Customer-Centric InsightFocuses on customer perceptions, aligning services with their needs.

* Step 2: Gap IdentificationPinpoints specific weaknesses (e.g., low responsiveness), enabling precise action.

* Step 3: BenchmarkingAllows comparison over time or against competitors to track progress.

* Outcome:Enhances service delivery and competitiveness in the service industry.

Exact Extract Explanation:

* SERVQUAL Description:The CIPS L5M4 Study Guide notes, "SERVQUAL assesses service quality through five dimensions-tangibles, reliability, responsiveness, assurance, and empathy-by measuring gaps between expectation and performance" (CIPS L5M4 Study Guide, Chapter 2, Section 2.5).

* Advantages:It states, "The model's strengths include its focus on customer perspectives, ability to identify service gaps, and utility as a benchmarking tool" (CIPS L5M4 Study Guide, Chapter 2, Section

2.5).This is vital for service-based procurement and contract management. References: CIPS L5M4 Study Guide, Chapter 2: Supply Chain Performance Management.

Question 13

Explain three different types of financial data you could collect on a supplier and what this data would tell you (25 marks)

Correct Answer:

See the answer in Explanation below:

Explanation:

Collecting financial data on a supplier is a critical step in supplier evaluation, ensuring they are financially stable and capable of fulfilling contractual obligations. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, analyzing financial data helps mitigate risks, supports strategic sourcing decisions, and ensures value for money in contracts. Below are three types of financial data, their purpose, and what they reveal about a supplier, explained in detail:

* Profitability Ratios (e.g., Net Profit Margin):

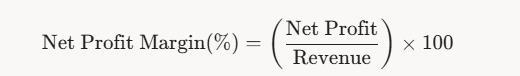

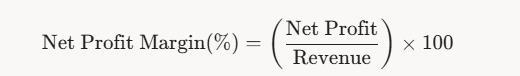

* Description: Profitability ratios measure a supplier's ability to generate profit from its operations. Net Profit Margin, for example, is calculated as:

A math equation with numbers and symbols AI-generated content may be incorrect.

* This data is typically found in the supplier's income statement.

* What It Tells You:

* Indicates the supplier's financial health and efficiency in managing costs. A high margin (e.g.,

15%) suggests strong profitability and resilience, while a low or negative margin (e.g., 2% or

-5%) signals potential financial distress.

* Helps assess if the supplier can sustain operations without passing excessive costs to the buyer.

* Example: A supplier with a 10% net profit margin is likely stable, but a declining margin over years might indicate rising costs or inefficiencies, posing a risk to contract delivery.

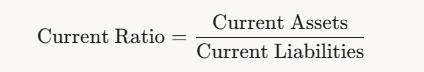

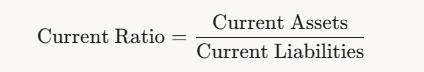

Liquidity Ratios (e.g., Current Ratio):

* Description: Liquidity ratios assess a supplier's ability to meet short-term obligations. The Current Ratio is calculated as:

A black text on a white background AI-generated content may be incorrect.

* This data is sourced from the supplier's balance sheet.

* What It Tells You:

* Shows whether the supplier can pay its debts as they come due. A ratio above 1 (e.g., 1.5) indicates good liquidity, while a ratio below 1 (e.g., 0.8) suggests potential cash flow issues.

* A low ratio may signal risk of delays or failure to deliver due to financial constraints.

* Example: A supplier with a Current Ratio of 2.0 can comfortably cover short-term liabilities, reducing the risk of supply disruptions for the buyer.

Debt-to-Equity Ratio:

* Description: This ratio measures a supplier's financial leverage by comparing its total debt to shareholders' equity:

A math equation with black text AI-generated content may be incorrect.

* This data is also found in the balance sheet.

* What It Tells You:

* Indicates the supplier's reliance on debt financing. A high ratio (e.g., 2.0) suggests heavy borrowing, increasing financial risk, while a low ratio (e.g., 0.5) indicates stability.

* A high ratio may mean the supplier is vulnerable to interest rate hikes or economic downturns, risking insolvency.

* Example: A supplier with a Debt-to-Equity Ratio of 0.3 is financially stable, while one with a ratio of 3.0 might struggle to meet obligations if market conditions worsen.

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide emphasizes the importance of financial due diligence in supplier selection and risk management, directly addressing the need to collect and analyze financial data. It highlights that "assessing a supplier's financial stability is critical to ensuring contract performance and mitigating risks," particularly in strategic or long-term contracts. The guide specifically references financial ratios as tools to evaluate supplier health, aligning with the types of data above.

* Detailed Explanation of Each Type of Data:

* Profitability Ratios (e.g., Net Profit Margin):

* The guide notes that profitability metrics like Net Profit Margin "provide insight into a supplier's operational efficiency and financial sustainability." A supplier with consistent or growing margins is likely to maintain quality and delivery standards, supporting contract reliability.

* Application: For XYZ Ltd (Question 7), a raw material supplier with a declining margin might cut corners on quality to save costs, risking production issues. L5M4 stresses that profitability data helps buyers predict long-term supplier viability, ensuring financial value.

* Liquidity Ratios (e.g., Current Ratio):

* Chapter 4 of the study guide highlights liquidity as a "key indicator of short-term financial health." A supplier with poor liquidity might delay deliveries or fail to fulfill orders, directly impacting the buyer's operations and costs.

* Practical Use: A Current Ratio below 1 might prompt XYZ Ltd to negotiate stricter payment terms or seek alternative suppliers, aligning with L5M4's focus on risk mitigation.

The guide advises using liquidity data to avoid over-reliance on financially weak suppliers.

* Debt-to-Equity Ratio:

* The guide identifies leverage ratios like Debt-to-Equity as measures of "financial risk exposure." A high ratio indicates potential instability, which could lead to supply chain disruptions if the supplier faces financial distress.

* Relevance: For a manufacturer like XYZ Ltd, a supplier with a high Debt-to-Equity Ratio might be a risk during economic downturns, as they may struggle to access credit for production. The guide recommends using this data to assess long-term partnership potential, a key financial management principle.

* Broader Implications:

* The guide advises combining these financial metrics for a comprehensive view. For example, a supplier with high profitability but poor liquidity might be profitable but unable to meet short- term obligations, posing a contract risk.

* Financial data should be tracked over time (e.g., 3-5 years) to identify trends-e.g., a rising Debt- to-Equity Ratio might signal increasing risk, even if current figures seem acceptable.

* In L5M4's financial management context, this data ensures cost control by avoiding suppliers likely to fail, which could lead to costly delays or the need to source alternatives at higher prices.

* Practical Application for XYZ Ltd:

* Profitability: A supplier with a 12% Net Profit Margin indicates stability, but XYZ Ltd should monitor for declines.

* Liquidity: A Current Ratio of 1.8 suggests the supplier can meet obligations, reducing delivery risks.

* Debt-to-Equity: A ratio of 0.4 shows low leverage, making the supplier a safer long-term partner.

* Together, these metrics help XYZ Ltd select a financially sound supplier, ensuring contract performance and financial efficiency.

Explanation:

Collecting financial data on a supplier is a critical step in supplier evaluation, ensuring they are financially stable and capable of fulfilling contractual obligations. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, analyzing financial data helps mitigate risks, supports strategic sourcing decisions, and ensures value for money in contracts. Below are three types of financial data, their purpose, and what they reveal about a supplier, explained in detail:

* Profitability Ratios (e.g., Net Profit Margin):

* Description: Profitability ratios measure a supplier's ability to generate profit from its operations. Net Profit Margin, for example, is calculated as:

A math equation with numbers and symbols AI-generated content may be incorrect.

* This data is typically found in the supplier's income statement.

* What It Tells You:

* Indicates the supplier's financial health and efficiency in managing costs. A high margin (e.g.,

15%) suggests strong profitability and resilience, while a low or negative margin (e.g., 2% or

-5%) signals potential financial distress.

* Helps assess if the supplier can sustain operations without passing excessive costs to the buyer.

* Example: A supplier with a 10% net profit margin is likely stable, but a declining margin over years might indicate rising costs or inefficiencies, posing a risk to contract delivery.

Liquidity Ratios (e.g., Current Ratio):

* Description: Liquidity ratios assess a supplier's ability to meet short-term obligations. The Current Ratio is calculated as:

A black text on a white background AI-generated content may be incorrect.

* This data is sourced from the supplier's balance sheet.

* What It Tells You:

* Shows whether the supplier can pay its debts as they come due. A ratio above 1 (e.g., 1.5) indicates good liquidity, while a ratio below 1 (e.g., 0.8) suggests potential cash flow issues.

* A low ratio may signal risk of delays or failure to deliver due to financial constraints.

* Example: A supplier with a Current Ratio of 2.0 can comfortably cover short-term liabilities, reducing the risk of supply disruptions for the buyer.

Debt-to-Equity Ratio:

* Description: This ratio measures a supplier's financial leverage by comparing its total debt to shareholders' equity:

A math equation with black text AI-generated content may be incorrect.

* This data is also found in the balance sheet.

* What It Tells You:

* Indicates the supplier's reliance on debt financing. A high ratio (e.g., 2.0) suggests heavy borrowing, increasing financial risk, while a low ratio (e.g., 0.5) indicates stability.

* A high ratio may mean the supplier is vulnerable to interest rate hikes or economic downturns, risking insolvency.

* Example: A supplier with a Debt-to-Equity Ratio of 0.3 is financially stable, while one with a ratio of 3.0 might struggle to meet obligations if market conditions worsen.

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide emphasizes the importance of financial due diligence in supplier selection and risk management, directly addressing the need to collect and analyze financial data. It highlights that "assessing a supplier's financial stability is critical to ensuring contract performance and mitigating risks," particularly in strategic or long-term contracts. The guide specifically references financial ratios as tools to evaluate supplier health, aligning with the types of data above.

* Detailed Explanation of Each Type of Data:

* Profitability Ratios (e.g., Net Profit Margin):

* The guide notes that profitability metrics like Net Profit Margin "provide insight into a supplier's operational efficiency and financial sustainability." A supplier with consistent or growing margins is likely to maintain quality and delivery standards, supporting contract reliability.

* Application: For XYZ Ltd (Question 7), a raw material supplier with a declining margin might cut corners on quality to save costs, risking production issues. L5M4 stresses that profitability data helps buyers predict long-term supplier viability, ensuring financial value.

* Liquidity Ratios (e.g., Current Ratio):

* Chapter 4 of the study guide highlights liquidity as a "key indicator of short-term financial health." A supplier with poor liquidity might delay deliveries or fail to fulfill orders, directly impacting the buyer's operations and costs.

* Practical Use: A Current Ratio below 1 might prompt XYZ Ltd to negotiate stricter payment terms or seek alternative suppliers, aligning with L5M4's focus on risk mitigation.

The guide advises using liquidity data to avoid over-reliance on financially weak suppliers.

* Debt-to-Equity Ratio:

* The guide identifies leverage ratios like Debt-to-Equity as measures of "financial risk exposure." A high ratio indicates potential instability, which could lead to supply chain disruptions if the supplier faces financial distress.

* Relevance: For a manufacturer like XYZ Ltd, a supplier with a high Debt-to-Equity Ratio might be a risk during economic downturns, as they may struggle to access credit for production. The guide recommends using this data to assess long-term partnership potential, a key financial management principle.

* Broader Implications:

* The guide advises combining these financial metrics for a comprehensive view. For example, a supplier with high profitability but poor liquidity might be profitable but unable to meet short- term obligations, posing a contract risk.

* Financial data should be tracked over time (e.g., 3-5 years) to identify trends-e.g., a rising Debt- to-Equity Ratio might signal increasing risk, even if current figures seem acceptable.

* In L5M4's financial management context, this data ensures cost control by avoiding suppliers likely to fail, which could lead to costly delays or the need to source alternatives at higher prices.

* Practical Application for XYZ Ltd:

* Profitability: A supplier with a 12% Net Profit Margin indicates stability, but XYZ Ltd should monitor for declines.

* Liquidity: A Current Ratio of 1.8 suggests the supplier can meet obligations, reducing delivery risks.

* Debt-to-Equity: A ratio of 0.4 shows low leverage, making the supplier a safer long-term partner.

* Together, these metrics help XYZ Ltd select a financially sound supplier, ensuring contract performance and financial efficiency.

Question 14

What tools are available for buyers to help procure items on the commodities market? (25 points)

Correct Answer:

See the answer in Explanation below:

Explanation:

Buyers in the commodities market can use various tools to manage procurement effectively, mitigating risks like price volatility. Below are three tools, detailed step-by-step:

* Futures Contracts

* Step 1: Understand the ToolAgreements to buy/sell a commodity at a set price on a future date, traded on exchanges.

* Step 2: ApplicationA buyer locks in a price for copper delivery in 6 months, hedging against price rises.

* Step 3: BenefitsProvides cost certainty and protection from volatility.

* Use for Buyers:Ensures predictable budgeting for raw materials.

* Options Contracts

* Step 1: Understand the ToolGives the right (not obligation) to buy/sell a commodity at a fixed price before a deadline.

* Step 2: ApplicationA buyer purchases an option to buy oil at $70/barrel, exercising it if prices exceed this.

* Step 3: BenefitsLimits downside risk while allowing gains from favorable price drops.

* Use for Buyers:Offers flexibility in volatile markets.

* Commodity Price Indices

* Step 1: Understand the ToolBenchmarks tracking average commodity prices (e.g., CRB Index, S&P GSCI).

* Step 2: ApplicationBuyers monitor indices to time purchases or negotiate contracts based on trends.

* Step 3: BenefitsEnhances market intelligence for strategic buying decisions.

* Use for Buyers:Helps optimize procurement timing and pricing.

Exact Extract Explanation:

The CIPS L5M4 Study Guide details these tools for commodity procurement:

* Futures Contracts:"Futures allow buyers to hedge against price increases, securing supply at a known cost" (CIPS L5M4 Study Guide, Chapter 6, Section 6.3).

* Options Contracts:"Options provide flexibility, protecting against adverse price movements while retaining upside potential" (CIPS L5M4 Study Guide, Chapter 6, Section 6.3).

* Price Indices:"Indices offer real-time data, aiding buyers in timing purchases and benchmarking costs" (CIPS L5M4 Study Guide, Chapter 6, Section 6.4).These tools are critical for managing commodity market risks. References: CIPS L5M4 Study Guide, Chapter 6: Commodity Markets and Procurement.

Explanation:

Buyers in the commodities market can use various tools to manage procurement effectively, mitigating risks like price volatility. Below are three tools, detailed step-by-step:

* Futures Contracts

* Step 1: Understand the ToolAgreements to buy/sell a commodity at a set price on a future date, traded on exchanges.

* Step 2: ApplicationA buyer locks in a price for copper delivery in 6 months, hedging against price rises.

* Step 3: BenefitsProvides cost certainty and protection from volatility.

* Use for Buyers:Ensures predictable budgeting for raw materials.

* Options Contracts

* Step 1: Understand the ToolGives the right (not obligation) to buy/sell a commodity at a fixed price before a deadline.

* Step 2: ApplicationA buyer purchases an option to buy oil at $70/barrel, exercising it if prices exceed this.

* Step 3: BenefitsLimits downside risk while allowing gains from favorable price drops.

* Use for Buyers:Offers flexibility in volatile markets.

* Commodity Price Indices

* Step 1: Understand the ToolBenchmarks tracking average commodity prices (e.g., CRB Index, S&P GSCI).

* Step 2: ApplicationBuyers monitor indices to time purchases or negotiate contracts based on trends.

* Step 3: BenefitsEnhances market intelligence for strategic buying decisions.

* Use for Buyers:Helps optimize procurement timing and pricing.

Exact Extract Explanation:

The CIPS L5M4 Study Guide details these tools for commodity procurement:

* Futures Contracts:"Futures allow buyers to hedge against price increases, securing supply at a known cost" (CIPS L5M4 Study Guide, Chapter 6, Section 6.3).

* Options Contracts:"Options provide flexibility, protecting against adverse price movements while retaining upside potential" (CIPS L5M4 Study Guide, Chapter 6, Section 6.3).

* Price Indices:"Indices offer real-time data, aiding buyers in timing purchases and benchmarking costs" (CIPS L5M4 Study Guide, Chapter 6, Section 6.4).These tools are critical for managing commodity market risks. References: CIPS L5M4 Study Guide, Chapter 6: Commodity Markets and Procurement.

- Latest Upload

- 121Microsoft.MS-700.v2025-12-27.q286

- 110SAP.C-BCFIN-2502.v2025-12-27.q12

- 115SAP.C-BCBTM-2502.v2025-12-26.q9

- 122SAP.C_THR89_2505.v2025-12-26.q45

- 115SAP.C-BCBTM-2509.v2025-12-26.q10

- 175IAPP.AIGP.v2025-12-25.q64

- 156CISI.UAE-Financial-Rules-and-Regulations.v2025-12-25.q35

- 187SAP.C-S4TM-2023.v2025-12-25.q82

- 129EMC.D-VXR-DS-00.v2025-12-24.q43

- 186Splunk.SPLK-5001.v2025-12-24.q37