Question 1

You are a member of the Chartered Institute of Management Accountants (CIMA) and you have recently taken up the position of Sales Manager with a company that is facing financial difficulties. The company's terms include a commitment to maintain specified profitability, liquidity and solvency measures; failure to do so would render bank loans immediately repayable. The draft financial statements show that the company has not succeeded in complying with all of these requirements.

The financial results are very dependent on various estimates such as receivables impairments. The Chief Executive Officer (CEO) has suggested that these be recalculated so as to bring the financial results within the requirements of the bank. He has asked you to sign pre-dated internal documentation which would imply that, as Sales Manager, you initiated these changes in the belief that they would enhance the accuracy of the Financial Statements.

Which TWO of the following courses of action available to you would be ethically acceptable according to the CIMA Code of Ethics?

The financial results are very dependent on various estimates such as receivables impairments. The Chief Executive Officer (CEO) has suggested that these be recalculated so as to bring the financial results within the requirements of the bank. He has asked you to sign pre-dated internal documentation which would imply that, as Sales Manager, you initiated these changes in the belief that they would enhance the accuracy of the Financial Statements.

Which TWO of the following courses of action available to you would be ethically acceptable according to the CIMA Code of Ethics?

Question 2

HGY is a major global corporation that has decided to implement the COSO Enterprise Risk Management Framework and integrate management practices throughout the organisation Which THREE of the following would be appropriate for HGY?

Question 3

The long-term prospects for interest rates in the UK and the USA are 2% and 6% per annum respectively.

The GBP/USD spot rate is currently GBP/USD1.71.

Using interest rate parity theory, what GBP/USD spot rate would you expect to see in six months' time?

The GBP/USD spot rate is currently GBP/USD1.71.

Using interest rate parity theory, what GBP/USD spot rate would you expect to see in six months' time?

Question 4

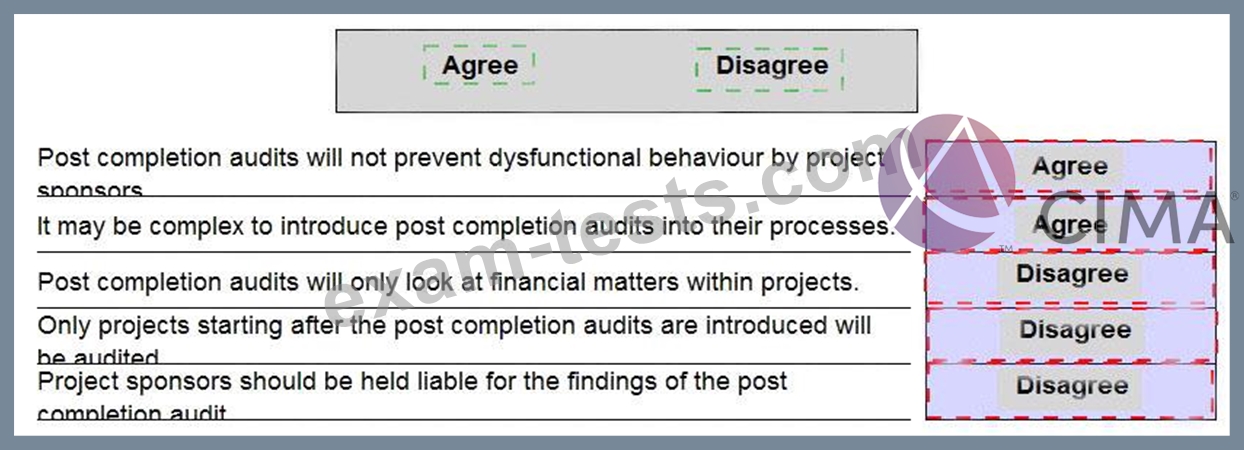

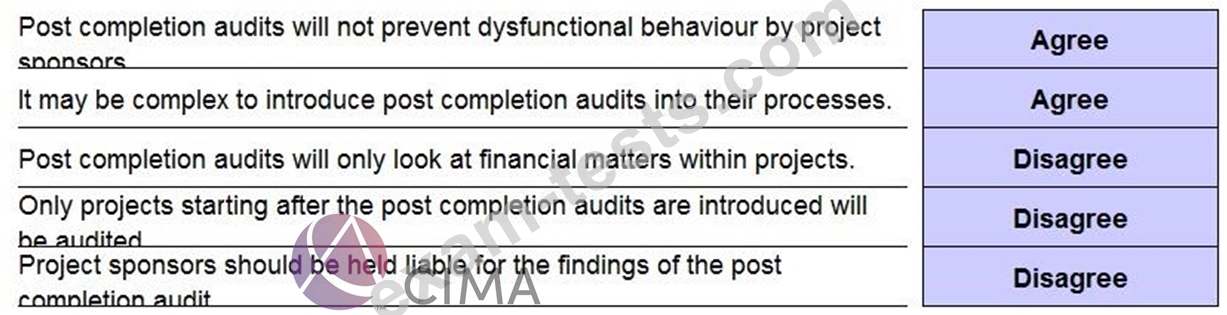

A's directors do not believe that they always get value for money from their investment in capital projects.

Over the past decade the company has invested in 55 projects that have cost more than $1m. They are considering introducing a system of post completion audit to see if this will help them to understand any problems they have had with projects in the past. They hope to use the results of the post completion audits to significantly improve the results of their capital investments State whether you agree or disagree with the points raised by A's directors.

Over the past decade the company has invested in 55 projects that have cost more than $1m. They are considering introducing a system of post completion audit to see if this will help them to understand any problems they have had with projects in the past. They hope to use the results of the post completion audits to significantly improve the results of their capital investments State whether you agree or disagree with the points raised by A's directors.

Question 5

The managers of a company are agents for the shareholders tasked with increasing shareholders' wealth.

Which of the following will usually increase shareholders' wealth?

Which of the following will usually increase shareholders' wealth?