Question 91

SDF has a variable rate loan of $100 million on which it is paying interest of LIBOR + 2%.

SDF entered into a swap with CV bank to convert this to a fixed rate 7% loan. CV bank charges an annual commission of 0.3% for making this arrangement.

Calculate the net payment from SDF to CV bank at the end of the first year if LIBOR was 3% throughout the year.

Give your answer in $ million, to one decimal place.

SDF entered into a swap with CV bank to convert this to a fixed rate 7% loan. CV bank charges an annual commission of 0.3% for making this arrangement.

Calculate the net payment from SDF to CV bank at the end of the first year if LIBOR was 3% throughout the year.

Give your answer in $ million, to one decimal place.

Question 92

A project has been evaluated on the basis that it will cost $14 million and will have a net present value of $2.3 million.

The project has commenced and $3 million of the initial $14 million has been invested. A problem has been discovered that will cost an additional $2.5 million to rectify. The $2.5 million will be payable immediately.

What is the NPV of continuing with this project?

The project has commenced and $3 million of the initial $14 million has been invested. A problem has been discovered that will cost an additional $2.5 million to rectify. The $2.5 million will be payable immediately.

What is the NPV of continuing with this project?

Question 93

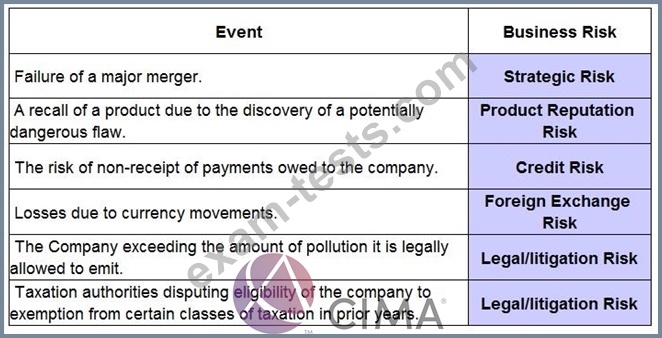

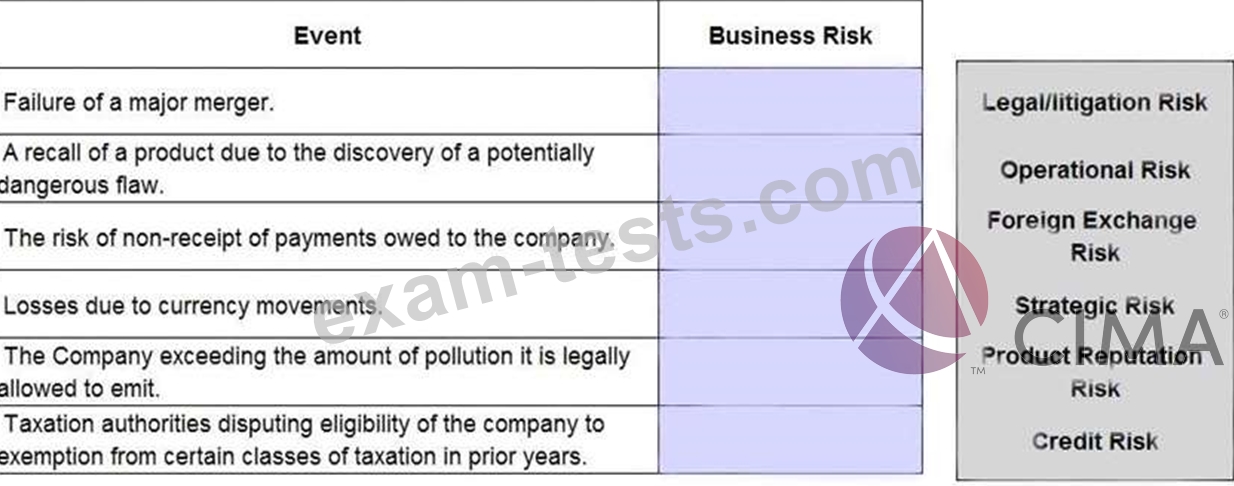

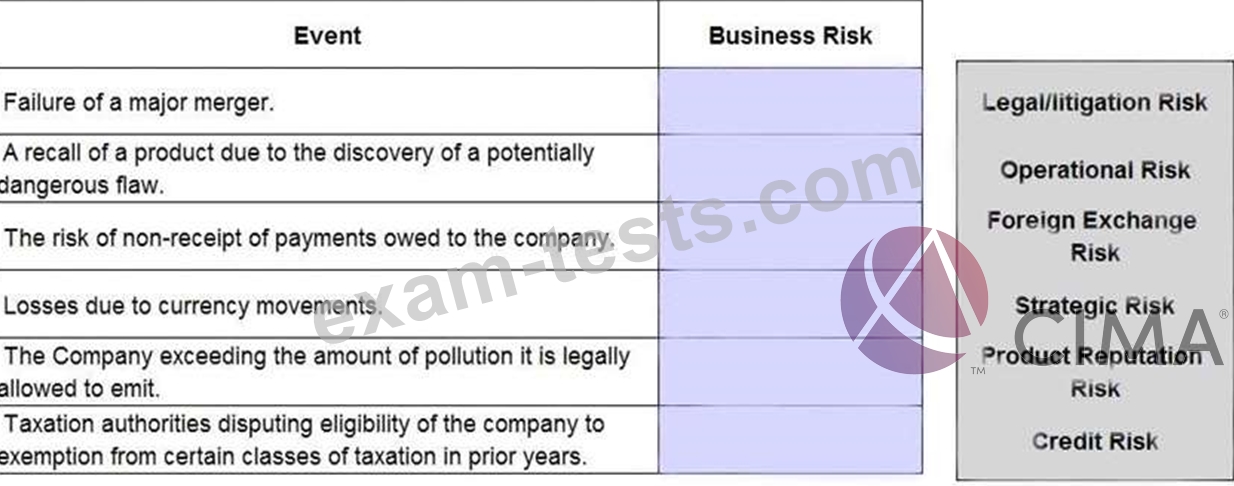

Identify, from the list provided, which category of business risk most accurately describes the events detailed below.

Question 94

Jo is a well known entrepreneur who founded JIS. a global producer or high technology equipment JIS has grown rapidly and was listed two years ago JIS's share price has grown steadily since its listing Jo serves as both CEO and Chair A recent newspaper article has suggested that JIS would benefit from having a separate CEO and Chair Which TWO of the following arguments are valid?

Question 95

The senior manager in the accounts department is going on annual leave for three weeks and Jo, a supervisor is being put in charge of the department for that time.

Which TWO of the following statements are correct?

Which TWO of the following statements are correct?