Question 26

A US company enters into a five year borrowing with bank A at a floating rate of USD Libor plus 2%.

It simultaneously enters into an interest rate swap with bank B at 3.5% fixed against USD Libor plus 1%.

What is the hedged borrowing rate, taking the borrowing and swap into account?

Give your answer to 1 decimal place

It simultaneously enters into an interest rate swap with bank B at 3.5% fixed against USD Libor plus 1%.

What is the hedged borrowing rate, taking the borrowing and swap into account?

Give your answer to 1 decimal place

Question 27

H Ltd is a company providing postal and courier services to small businesses. Customers pay a monthly or annual subscription fee to use the service, plus a very small fee for each item delivered.

A year ago, H employed a new sales team. Their remuneration is dependent on the number of new customers they sign up. Sales increased dramatically in the first six months, but now difficulties are emerging such as new customers dropping their subscription once the initial period has expired; subscriber direct debits being returned unpaid; subscribers going out of business and other similar issues.

Which of the following would be appropriate to help resolve these problems?

A year ago, H employed a new sales team. Their remuneration is dependent on the number of new customers they sign up. Sales increased dramatically in the first six months, but now difficulties are emerging such as new customers dropping their subscription once the initial period has expired; subscriber direct debits being returned unpaid; subscribers going out of business and other similar issues.

Which of the following would be appropriate to help resolve these problems?

Question 28

GHJ makes large export sales to customers in Country A, whose currency fluctuates significantly against GHJ's home currency. GHJ also makes large purchases from suppliers in Country A.

All of these transactions are in Country A's currency.

GHJ's Treasurer does not actively hedge currency risks because there is a natural hedge in place due to the company making both sales and purchases in the same currency.

GHJ's Board has instructed the Treasurer to put active hedging measures in place because the Risk Report would otherwise have to disclose the fact that GHJ has a currency risk which is not actively hedged.

Which of the following statements are correct?

All of these transactions are in Country A's currency.

GHJ's Treasurer does not actively hedge currency risks because there is a natural hedge in place due to the company making both sales and purchases in the same currency.

GHJ's Board has instructed the Treasurer to put active hedging measures in place because the Risk Report would otherwise have to disclose the fact that GHJ has a currency risk which is not actively hedged.

Which of the following statements are correct?

Question 29

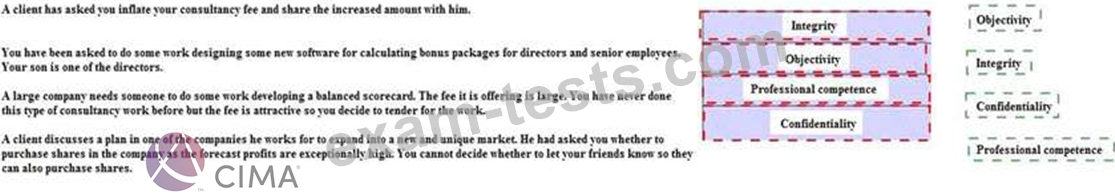

Select the correct ethical principle that corresponds to each ethical dilemma described.

Question 30

VBN is a multinational company that has 60 subsidiary companies that operate in 11 countries. VBN evaluates the performance of each subsidiary as an investment centre, using residual income to measure performance.

Which THREE of the following threats of dysfunctional behaviour may arise from VBN's use of residual income to measure subsidiaries' performance?

Which THREE of the following threats of dysfunctional behaviour may arise from VBN's use of residual income to measure subsidiaries' performance?