Question 96

A key stakeholder who has high influence and very high interest in a portfolio has moved to another business unit with less interest in that portfolio. The portfolio manager should respond by:

Question 97

Which type of analysis is most appropriate for a portfolio manager to use when optimizing a portfolio with reported information as an input?

Question 98

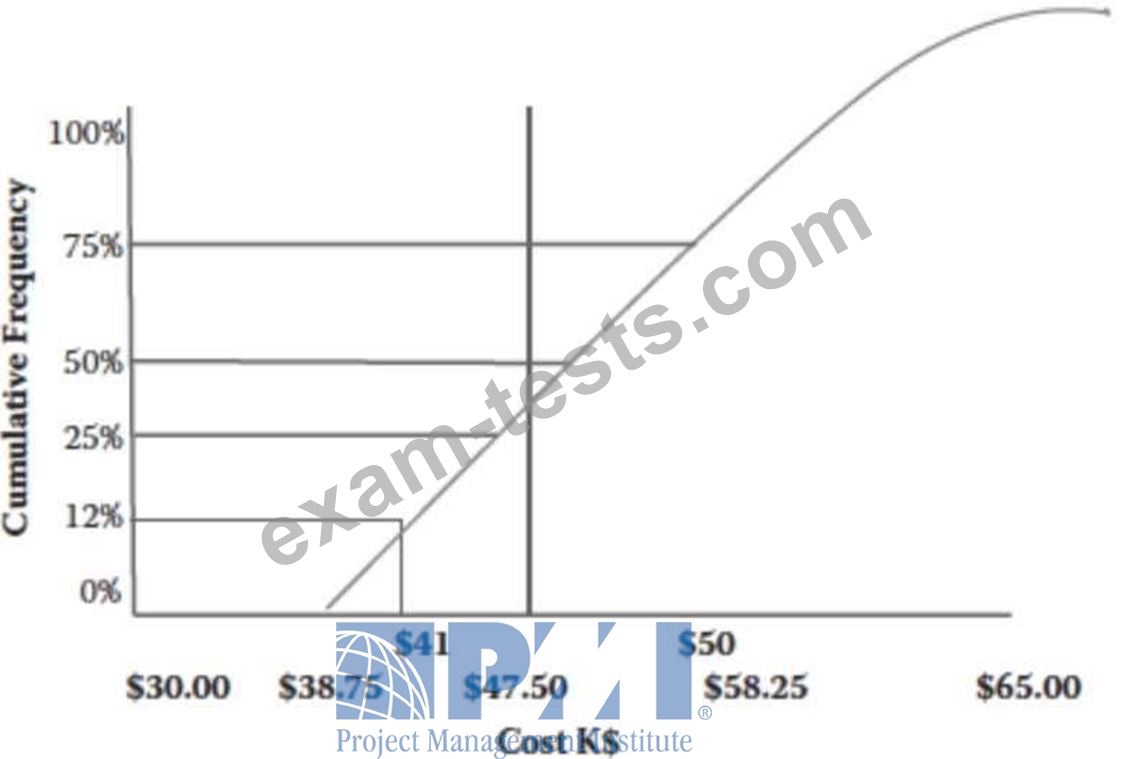

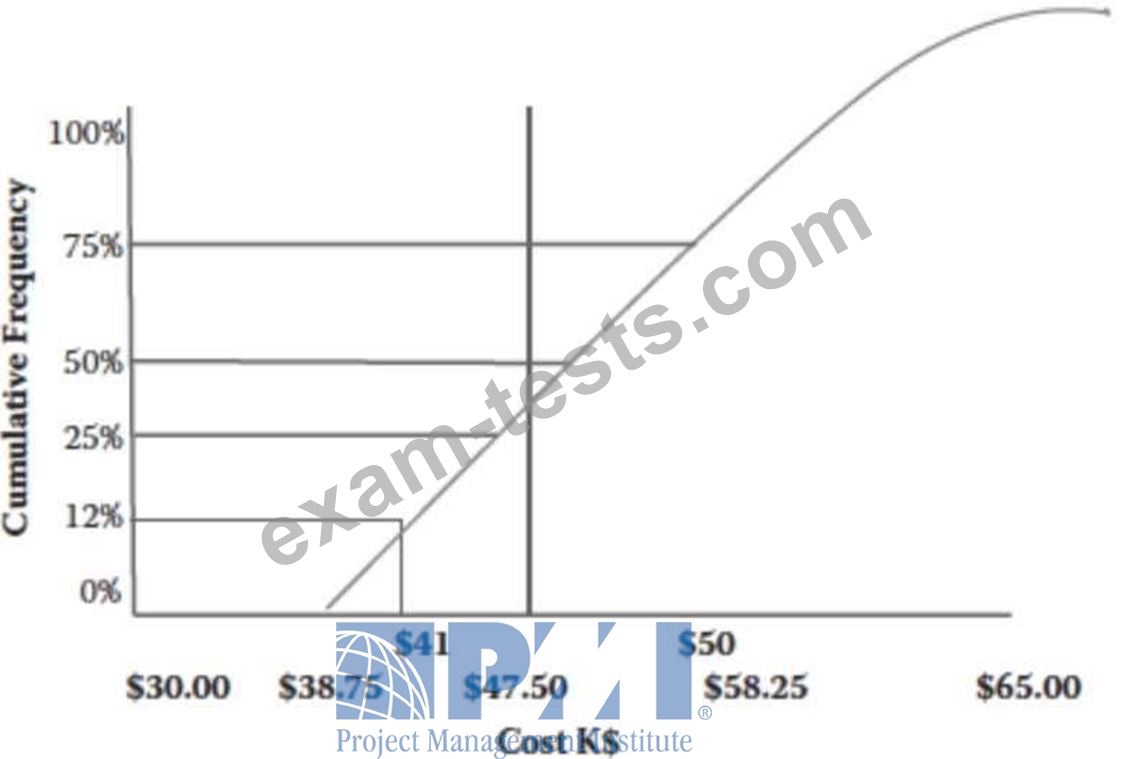

Review the following graphic. Assume now your portfolio is only 12% likely to meet is target of

$41,000. Your Portfolio Review Board is dissatisfied in your management of the value of the overall portfolio. You explain the current mix of components is too risk adverse, and additional investment is required. The Board Chair then wants the needed investment to have a 75% likelihood, and you state it is:

$41,000. Your Portfolio Review Board is dissatisfied in your management of the value of the overall portfolio. You explain the current mix of components is too risk adverse, and additional investment is required. The Board Chair then wants the needed investment to have a 75% likelihood, and you state it is:

Question 99

A new project manager has been assigned to a project in an approved portfolio. What should the portfolio manager do to ensure that the new project manager will be able to support the portfolio management requirements and processes?

Question 100

Following an organizational change and restructuring. One of the Portfolio Key Stakeholders got a promotion and became a director. She became less interested in your portfolio and you used to engage her very closely.

What is your best course of action in this case?

What is your best course of action in this case?