Question 71

A risk analyst analyzing the positions for a proprietary trading desk determines that the combined annual variance of the desk's positions is 0.16. The value of the portfolio is $240m. What is the 10-day stand alone VaR in dollars for the desk at a confidence level of 95%? Assume 250 trading days in a year.

Question 72

As part of designing a reverse stress test, at what point should a bank's business plan be considered unviable (ie the point where it can be considered to have failed)?

Question 73

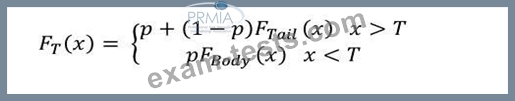

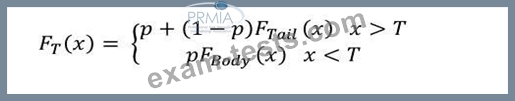

When fitting a distribution in excess of a threshold as part of the body-tail distribution method described by the equation below, how is the parameter 'p' calculated.

Here, F(x) is the severity distribution. F(Tail) and F(Body) are the parametric distributions selected for the tail and the body, and T is the threshold in excess of which the tail is considered to begin.

Here, F(x) is the severity distribution. F(Tail) and F(Body) are the parametric distributions selected for the tail and the body, and T is the threshold in excess of which the tail is considered to begin.

Question 74

Which of the following steps are required for computing the total loss distribution for a bank for operational risk once individual UoM level loss distributions have been computed from the underlhying frequency and severity curves:

I. Simulate number of losses based on the frequency distribution

II. Simulate the dollar value of the losses from the severity distribution III. Simulate random number from the copula used to model dependence between the UoMs IV. Compute dependent losses from aggregate distribution curves

I. Simulate number of losses based on the frequency distribution

II. Simulate the dollar value of the losses from the severity distribution III. Simulate random number from the copula used to model dependence between the UoMs IV. Compute dependent losses from aggregate distribution curves

Question 75

According to the implied capital model, operational risk capital is estimated as: