Question 1

If the systematic VaR for an equity portfolio is $100 and the specific VaR is $80, then which of the following is true in relation to the total VaR:

Question 2

If the marginal probabilities of default for a corporate bond for years 1, 2 and 3 are 2%, 3% and 4% respectively, what is the cumulative probability of default at the end of year 3?

Question 3

Which of the following will be a loss not covered by operational risk as defined under Basel II?

Question 4

Which of the following statements is true:

I. When averaging quantiles of two Pareto distributions, the quantiles of the averaged models are equal to the geometric average of the quantiles of the original models based upon the number of data items in each original model.

II. When modeling severity distributions, we can only use distributions which have fewer parameters than the number of datapoints we are modeling from.

III. If an internal loss data based model covers the same risks as a scenario based model, they can can be combined using the weighted average of their parameters.

IV If an internal loss model and a scenario based model address different risks, the models can be combined by taking their sums.

I. When averaging quantiles of two Pareto distributions, the quantiles of the averaged models are equal to the geometric average of the quantiles of the original models based upon the number of data items in each original model.

II. When modeling severity distributions, we can only use distributions which have fewer parameters than the number of datapoints we are modeling from.

III. If an internal loss data based model covers the same risks as a scenario based model, they can can be combined using the weighted average of their parameters.

IV If an internal loss model and a scenario based model address different risks, the models can be combined by taking their sums.

Question 5

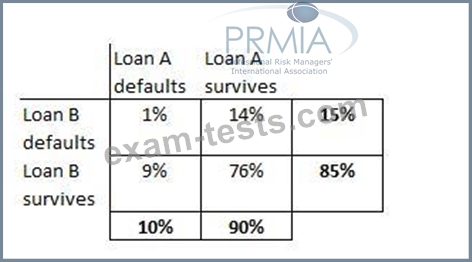

A portfolio has two loans, A and B, each worth $1m. The probability of default of loan A is 10% and that of loan B is 15%. The probability of both loans defaulting together is 1%. Calculate the expected loss on the portfolio.