Question 51

Eton Ltd. operates a manufacturing process that produces product A.

Information for this process last month is as follows:

(a) Opening work in progress - 2,500 kg valued at £2,000 for direct material and £1,500 for labour and overheads.

(b) Materials input - 25,000 kg at £2.10 per kg.

(c) Labour - £10,000

(d) Overheads - £5,000

(e) Output during the month - 20,000 kg.

(f) There were 7,500 units of closing work in progress which was complete as to materials and 30% complete as to conversion.

(g) Normal loss for the month was 3% of input and all losses have a scrap value of £1 per kg.

What was the average cost per kg of finished output during the month?

Information for this process last month is as follows:

(a) Opening work in progress - 2,500 kg valued at £2,000 for direct material and £1,500 for labour and overheads.

(b) Materials input - 25,000 kg at £2.10 per kg.

(c) Labour - £10,000

(d) Overheads - £5,000

(e) Output during the month - 20,000 kg.

(f) There were 7,500 units of closing work in progress which was complete as to materials and 30% complete as to conversion.

(g) Normal loss for the month was 3% of input and all losses have a scrap value of £1 per kg.

What was the average cost per kg of finished output during the month?

Question 52

Which of the following statements are true of Risk? Select ALL that apply.

Question 53

A company operates an integrated standard cost accounting system. The standard price of raw material A is

$20 per litre. At the start of period 1, the inventory of 500 litres of raw material A was valued at $20 per litre.

During period 1, 100 litres of raw material A were purchased at an actual price of $21 per litre. During period

2, 550 litres of raw material A were issued to Job 789.

In respect of the above events, which TWO of the following statements are correct? (Choose two.)

$20 per litre. At the start of period 1, the inventory of 500 litres of raw material A was valued at $20 per litre.

During period 1, 100 litres of raw material A were purchased at an actual price of $21 per litre. During period

2, 550 litres of raw material A were issued to Job 789.

In respect of the above events, which TWO of the following statements are correct? (Choose two.)

Question 54

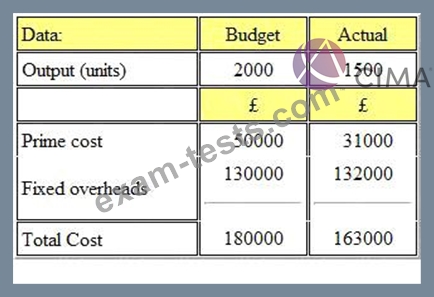

Refer to the exhibit.

A company issued its production budget based on an anticipated output of 2000 units. The actual output for the period was 1500 units. The details of the costs are shown below:

The budget volume variance was:

A company issued its production budget based on an anticipated output of 2000 units. The actual output for the period was 1500 units. The details of the costs are shown below:

The budget volume variance was:

Question 55

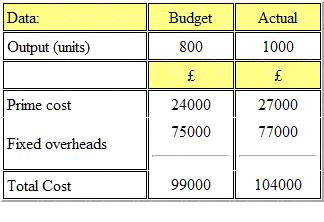

Refer to the exhibit.

A company issued its production budget based on an anticipated output of 800 units. Actual output was 1000 units. The details of the costs are shown below:

The budget volume variance was:

A company issued its production budget based on an anticipated output of 800 units. Actual output was 1000 units. The details of the costs are shown below:

The budget volume variance was: