Question 36

C Ltd produces a chemical in a single process. Information for this process last month is as follows:

(a) Opening work in progress - 10000 kg valued at £10000 for direct material and £7500 for conversion costs.

(b) Materials input - 25000 kg at £1.10 per kg.

(c) Conversion costs - £17000

(d) Output during the month - 23000 kg.

(e) There were 7500 units of closing work in progress which was complete as to materials and 30% complete as to conversion.

(f) Normal loss for the month was 10% of input and all losses have a scrap value of 80p per kg.

What was the average cost per kg of finished output during the month?

(a) Opening work in progress - 10000 kg valued at £10000 for direct material and £7500 for conversion costs.

(b) Materials input - 25000 kg at £1.10 per kg.

(c) Conversion costs - £17000

(d) Output during the month - 23000 kg.

(e) There were 7500 units of closing work in progress which was complete as to materials and 30% complete as to conversion.

(f) Normal loss for the month was 10% of input and all losses have a scrap value of 80p per kg.

What was the average cost per kg of finished output during the month?

Question 37

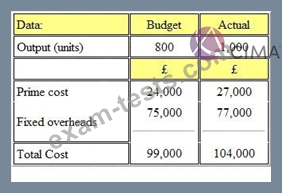

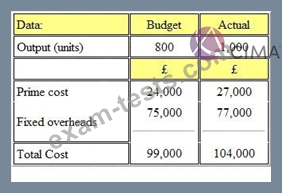

Refer to the exhibit.

A company issued its production budget based on an anticipated output of 800 units. Actual output was 1,000 units. The details of the costs are shown below:

The total budget variance was:

A company issued its production budget based on an anticipated output of 800 units. Actual output was 1,000 units. The details of the costs are shown below:

The total budget variance was:

Question 38

A company has spent $5,000 on a report into the viability of using a subcontractor. The report highlighted the following:

A machine purchased six years ago for $30,000 would become surplus to requirements. It has a written-down value of $10,000 but would be resold for $12,000.

A machine operator would be made redundant and would receive a redundancy payment of $40,000.

The administration of the subcontractor arrangement would cost the company $25,000 each year.

Which THREE of the following are relevant for the decision? (Choose three.)

A machine purchased six years ago for $30,000 would become surplus to requirements. It has a written-down value of $10,000 but would be resold for $12,000.

A machine operator would be made redundant and would receive a redundancy payment of $40,000.

The administration of the subcontractor arrangement would cost the company $25,000 each year.

Which THREE of the following are relevant for the decision? (Choose three.)

Question 39

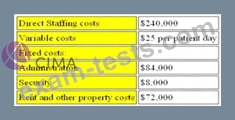

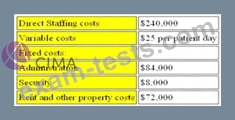

Refer to the exhibit.

X Enterprises runs a private nursing home for the elderly. The company are concerned that bed occupancy rates have been falling over the past 2 years with a consequential effect on profit. They have drawn up a budget for next year as follows:

The nursing home currently charges $90 per patient day.

Based on the budgeted figures and the current charge per day, what would be the break-even point in patient days?

X Enterprises runs a private nursing home for the elderly. The company are concerned that bed occupancy rates have been falling over the past 2 years with a consequential effect on profit. They have drawn up a budget for next year as follows:

The nursing home currently charges $90 per patient day.

Based on the budgeted figures and the current charge per day, what would be the break-even point in patient days?

Question 40

Which of the following industries would not use process costing?