Question 1

Refer to the exhibit.

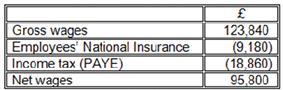

DS is manufacturing company that uses an integrated accounting system. The following payroll data is available for the month of August:

The Employers' National Insurance for the period was $13,790. An analysis of the wages is as follows:

Which of the following factors affect the budgeted cash flow:

(a) Funds from the issue of share capital

(b) Bank Interest on a long term loan

(c) Depreciation on fixed assets

(d) Bad debt write off

DS is manufacturing company that uses an integrated accounting system. The following payroll data is available for the month of August:

The Employers' National Insurance for the period was $13,790. An analysis of the wages is as follows:

Which of the following factors affect the budgeted cash flow:

(a) Funds from the issue of share capital

(b) Bank Interest on a long term loan

(c) Depreciation on fixed assets

(d) Bad debt write off

Question 2

Refer to the exhibit.

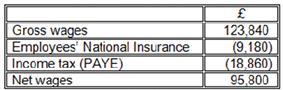

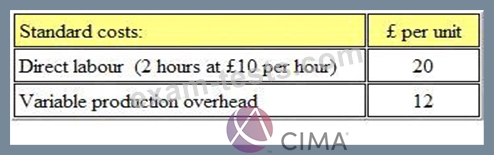

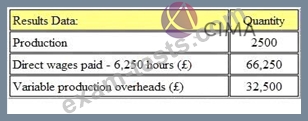

A company manufactures a single product, and relevant data is as follows:

Note. Overheads are assumed to be related to direct labour hours.

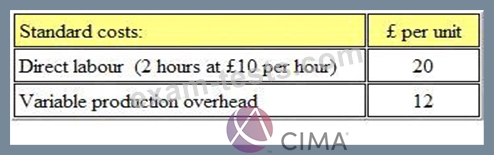

The actual results for the period were as follows:

What is the variable overhead expenditure variance?

A company manufactures a single product, and relevant data is as follows:

Note. Overheads are assumed to be related to direct labour hours.

The actual results for the period were as follows:

What is the variable overhead expenditure variance?

Question 3

Refer to the exhibit

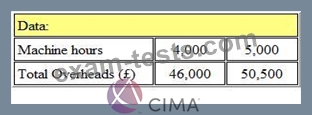

Zeff Ltd has forecast that the relationship between total overheads and machine hours will be as follows:

If the budget is to be based on 4,000 machine hours, the fixed overhead absorption rate will be:

Give your answer to 2 decimal places.

Zeff Ltd has forecast that the relationship between total overheads and machine hours will be as follows:

If the budget is to be based on 4,000 machine hours, the fixed overhead absorption rate will be:

Give your answer to 2 decimal places.

Question 4

The standard labour hours for all products manufactured by a company include an allowance for idle time. Idle time is budgeted to be 5% of total hours worked. Each unit of product G requires an input of 9.5 active labour hours. The labour rate is $12 per hour.

The standard labour cost shown on the standard cost card for one unit of product G will be

The standard labour cost shown on the standard cost card for one unit of product G will be

Question 5

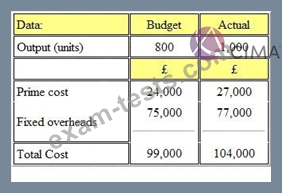

Refer to the exhibit.

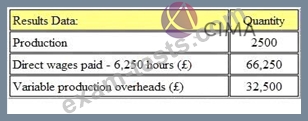

A company issued its production budget based on an anticipated output of 800 units. Actual output was 1000 units. The details of the costs are shown below:

The budget expenditure variance was:

A company issued its production budget based on an anticipated output of 800 units. Actual output was 1000 units. The details of the costs are shown below:

The budget expenditure variance was: