Question 286

You evaluate the monthly performance of your portfolio managers against a broad market index. At the end of each year, you add up the number of months in which their performance exceeded that of the market index. If the probability of beating the market index each month, after expenses and sales loads, is

6 5%, what is the mean and variance of the number of months in a year a manager would beat the index?

6 5%, what is the mean and variance of the number of months in a year a manager would beat the index?

Question 287

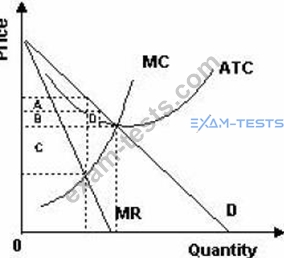

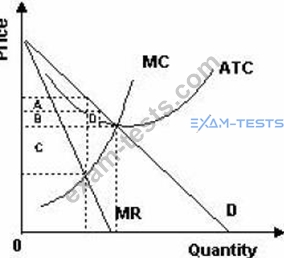

Refer to the graph below. Which rectangle represents monopolists' profit?

Question 288

What are the main criteria to consider in the policy statement with regard to asset allocation?

I). What asset classes to consider for investment.

II). What normal policy weights to assign to each eligible asset class.

III). The allowable allocation ranges based on policy weights.

I). What asset classes to consider for investment.

II). What normal policy weights to assign to each eligible asset class.

III). The allowable allocation ranges based on policy weights.

Question 289

When the market is in backwardation, the roll yield will be ______ for a hedger.

Question 290

On January 1, a business exchanged a plant asset with a book value of $1,500 for a similar asset that had a price of $23,000. The business received a trade-in allowance of $2,100 on the old plant asset.

The income-tax method was used to record this trade. What was the result of the exchange?

The income-tax method was used to record this trade. What was the result of the exchange?