Question 306

The monopolistically competitive industry produces an output at which price equals

Question 307

You invest $100 in a risky asset with an expected rate of return of 12% and a standard deviation of

1 5% and a T-bill with a rate of return of 5%. What percentages of your money must be invested in the risk-free asset and the risky asset, respectively, to form a portfolio with a standard deviation of 6%?

1 5% and a T-bill with a rate of return of 5%. What percentages of your money must be invested in the risk-free asset and the risky asset, respectively, to form a portfolio with a standard deviation of 6%?

Question 308

Which of the following items is a credit in the U.S. balance of trade?

Question 309

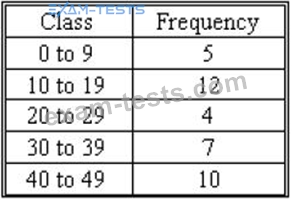

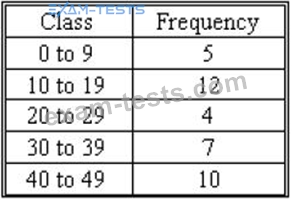

For the following frequency distribution:

The median of the distribution is:

The median of the distribution is:

Question 310

Company B is considering a capital investment project. The appropriate discount rate for the project is WACC = 5.25%. The project has the following NPV and IRR: NPV = - $4,250,000 IRR = 3.01%.

Which of the following statements is true?

I). The project should be accepted since IRR WACC

II). The project should be accepted since NPV 0.

Which of the following statements is true?

I). The project should be accepted since IRR WACC

II). The project should be accepted since NPV 0.