Question 96

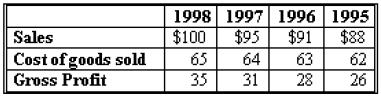

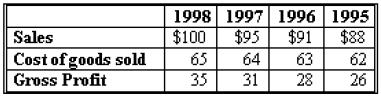

Bridget's Midget Widget

Gross margin:

Gross margin:

Question 97

Which of the following is (are) true about the Capital Market Theory?

I). A portfolio that lies above the Security Market Line (SML) is under-priced.

II). The correlation between two portfolios on the SML equals +1.

III). Portfolios that lie on the Capital Market Line (CML) are as completely diversified as possible.

IV). Portfolios that lie on the SML are not necessarily completely diversified.

I). A portfolio that lies above the Security Market Line (SML) is under-priced.

II). The correlation between two portfolios on the SML equals +1.

III). Portfolios that lie on the Capital Market Line (CML) are as completely diversified as possible.

IV). Portfolios that lie on the SML are not necessarily completely diversified.

Question 98

The years in which the United States gross domestic product decreased would be an example of which level of measurement.

Question 99

Beaumont Bearings is analyzing two mutually exclusive projects with the following cash flows. Its cost of capital is 9%.

The NPV of projects X and Y are

The NPV of projects X and Y are

Question 100

Consider a two-year currency swap, with semi-annual settlements. It is fixed dollar rate for fixed yen rate swap. The initial exchange rate is 99 Yen to the dollar. Notional principal is $100 million. The fixed dollar rate is 6%. The fixed yen rate is 2%. Who pays whom how much at the first settlement date?