Question 1

A company manufactures a single product and absorbs fixed production overheads at a predetermined rate based on budgeted expenditure and budgeted units.

Which TWO of the following would definitely lead to an over absorption of fixed production overheads?

Which TWO of the following would definitely lead to an over absorption of fixed production overheads?

Question 2

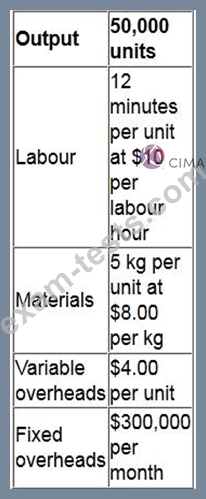

A company's budgeted data for the period are shown in the table below.

There is a stepped increase in fixed overheads of $10,000 when production exceeds 52,000 units.

Actual production for the period was 60,000 units.

What is the flexed budgeted cost for the period?

Give your answer as a whole number (in '000s).

There is a stepped increase in fixed overheads of $10,000 when production exceeds 52,000 units.

Actual production for the period was 60,000 units.

What is the flexed budgeted cost for the period?

Give your answer as a whole number (in '000s).

Question 3

Which of the following distinguishes risk from uncertainty?

Question 4

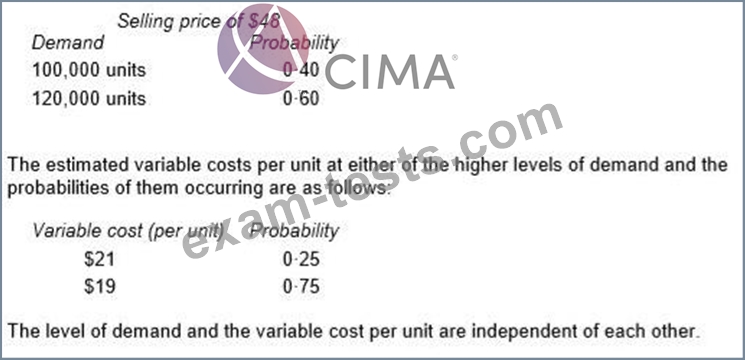

PL currently earns an annual contribution of $2,880,000 from the sale of 90,000 units of product B. Fixed costs are $800,000 per annum.

The management of PL is considering reducing the selling price per unit to $48. The estimated levels of demand at the revised selling price and the probabilities of them occurring are as follows:

Calculate the probability that the profit will increase from its current level if the selling price is reduced to $48.

The management of PL is considering reducing the selling price per unit to $48. The estimated levels of demand at the revised selling price and the probabilities of them occurring are as follows:

Calculate the probability that the profit will increase from its current level if the selling price is reduced to $48.

Question 5

A project has an expected value of $165,250.

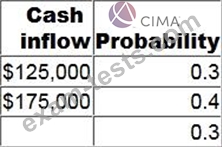

The estimates of cash inflows and their probabilities are:

What is the missing cash inflow?

Give your answer as a whole number.

The estimates of cash inflows and their probabilities are:

What is the missing cash inflow?

Give your answer as a whole number.