Question 36

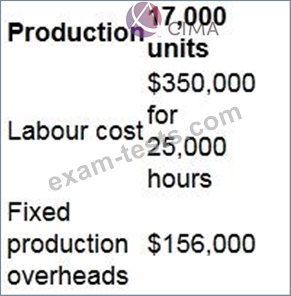

The standard production cost of making a product is as follows:

What is the fixed production overhead capacity variance?

What is the fixed production overhead capacity variance?

Question 37

QR uses an activity based budgeting (ABB) system to budget product costs. It manufactures two products, product Q and product R. The budget details for these two products for the forthcoming period are as follows:

The total budgeted cost of setting up the machines is $74,400.

Select TWO potential benefits of using an activity based budgeting system.

The total budgeted cost of setting up the machines is $74,400.

Select TWO potential benefits of using an activity based budgeting system.

Question 38

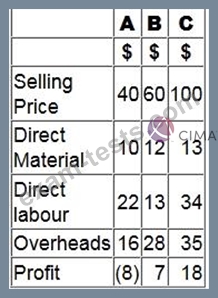

A company makes and sells three products A, B and C.

The selling prices and costs of the three products, using a traditional absoprtion costing system, are shown in the table below.

The company has undertaken an analysis of overhead costs using activity-based costing (ABC).

The revised overhead costs for products A, B and C are $6, $32 and $55 respectively.

When comparing the figures obtained under the two costing methods, which of the following statements are true?

Select ALL that apply.

The selling prices and costs of the three products, using a traditional absoprtion costing system, are shown in the table below.

The company has undertaken an analysis of overhead costs using activity-based costing (ABC).

The revised overhead costs for products A, B and C are $6, $32 and $55 respectively.

When comparing the figures obtained under the two costing methods, which of the following statements are true?

Select ALL that apply.

Question 39

XY can choose from four mutually exclusive projects. The projects will each last for one year and their net cash inflows will be determined by market conditions. The forecast net cash inflows for each of the possible outcomes are shown below.

If the company applies the maximin criterion the project chosen would be:

If the company applies the maximin criterion the project chosen would be:

Question 40

A small manufacturing company makes a single product. Direct labour costs and factory rent account for

80% and 15% of total cost respectively. Activity levels have not varied by more than 5% for a number of years and there is no evidence of operational inefficiency.

Which of the following is the most appropriate approach to budgeting for this company?

80% and 15% of total cost respectively. Activity levels have not varied by more than 5% for a number of years and there is no evidence of operational inefficiency.

Which of the following is the most appropriate approach to budgeting for this company?