Question 51

The net present value of the cost of operating a machine for the next 4 years is £6,340. The discount rate used is 10%.

What is the equivalent annual cost and the present value of the cost in perpetuity of operating this machine?

Use discount factors to 3 decimal places.

What is the equivalent annual cost and the present value of the cost in perpetuity of operating this machine?

Use discount factors to 3 decimal places.

Question 52

SQ has the opportunity to invest in project X. The net present value for project X is $12,600. Cash inflows occur in years 1, 2 and 3. The company's cost of capital is 14%.

Calculate the annualized equivalent annuity of project X.

Give your answer to the nearest whole $.

Calculate the annualized equivalent annuity of project X.

Give your answer to the nearest whole $.

Question 53

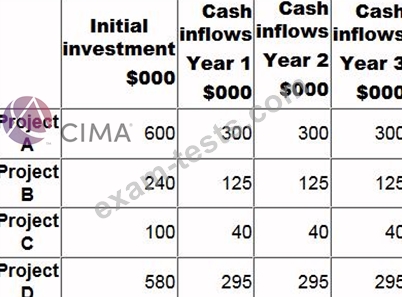

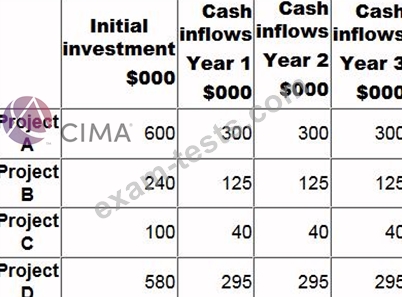

The following information is available for four investment projects:

A discount rate of 12% is appropriate for all four projects. The organization is subject to capital rationing and wishes to prioritise the projects using the profitability index (PI).

Which project has the highest PI?

A discount rate of 12% is appropriate for all four projects. The organization is subject to capital rationing and wishes to prioritise the projects using the profitability index (PI).

Which project has the highest PI?

Question 54

Which of the following statements is NOT correct?

Transfer prices between responsibility centers should be set at a level that:

Transfer prices between responsibility centers should be set at a level that:

Question 55

A company is classifying its quality costs to prepare a quality cost report. Which of the following are conformance costs?

Select ALL that apply.

Select ALL that apply.