Question 26

A project with a 6 year life generates a positive net present value of $1,100. The discount rate is 8%.

To the nearest $, the equivalent annual benefit is:

To the nearest $, the equivalent annual benefit is:

Question 27

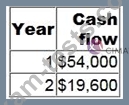

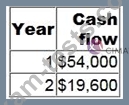

A project requires an initial investment of $50,000. It will generate positive cash flows for two years as follows.

The cost of capital is 12% per year.

What is the equivalent annual net present value of the project?

Give your answer to the nearest $10.

The cost of capital is 12% per year.

What is the equivalent annual net present value of the project?

Give your answer to the nearest $10.

Question 28

Which of the following statements is true?

Question 29

A company is investing in a huge diversification project. The plan is to develop and sell a whole new product line that they have never sold before. They've already started a massive marketing campaign for this new product line and they are getting good feedback in their market research.

They've had to use debt funding in order to finance the project, but they hope that the returns will be worth the investment and restructuring. If they are successful they will be a step ahead of all their competitors and offer something none of them can.

What is the risk appetite of this company?

They've had to use debt funding in order to finance the project, but they hope that the returns will be worth the investment and restructuring. If they are successful they will be a step ahead of all their competitors and offer something none of them can.

What is the risk appetite of this company?

Question 30

Which basis of transfer pricing retains the full autonomy of divisional managers?