Question 21

An organization is considering purchasing a new machine which will cost $600,000. The new machine will generate cost savings of $200,000 each year for five years. The cost of capital is 12%.

The profitability index (PI) for the investment in the new machine is:

Give your answer to one decimal place.

The profitability index (PI) for the investment in the new machine is:

Give your answer to one decimal place.

Question 22

ZZZ is a divisionalised company that uses the balanced scorecard approach to monitor divisional performance. Each measure on the scorecard is classified as green (if they are better than expected), amber (if expectations have been met) or red (if they are poorer than expected).

The Southern Division's scorecard shows that 90% of the measures are amber, 3% are green and 7% are red.

All of the red classifications are listed under the Learning and Growth perspective and have arisen largely because the division has lost a lot of staff to a major competitor who offered a better rate of pay.

Which THREE of the following statements are correct?

The Southern Division's scorecard shows that 90% of the measures are amber, 3% are green and 7% are red.

All of the red classifications are listed under the Learning and Growth perspective and have arisen largely because the division has lost a lot of staff to a major competitor who offered a better rate of pay.

Which THREE of the following statements are correct?

Question 23

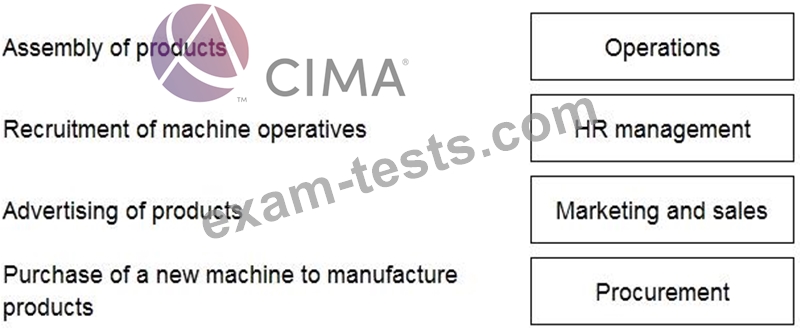

Using Porter's value chain, place the tokens to correctly categories the following activities of a manufacturing company.

Question 24

Which TWO of the following are examples of management information made possible by the availability of big data?

Question 25

The performance report for the production manager of a company for the last month included the following.

1,000 direct labor hours were worked at a basic rate of pay of $10 per hour. 200 of these hours were worked during overtime for which a 30% overtime premium was paid. 80 of these overtime hours were to fulfill a customer order that had originally been planned for manufacture next month. The sales manager had agreed to bring forward the delivery of this order at the request of the customer. The remaining overtime hours were due to unexpected inefficiency of the workforce; this has been traced to poor supervision by a junior manager.

Material costs included the following:

$5,300 of material A. Material A is a commodity and, due to changes on the global market, the actual unit cost of this material for last month was 6% higher than had been expected

$5,250 of material B. The usage of material B last month was 5% higher than it should have been due to faulty workmanship on the production line.

What is the total value of the above costs that was controllable by the production manager?

1,000 direct labor hours were worked at a basic rate of pay of $10 per hour. 200 of these hours were worked during overtime for which a 30% overtime premium was paid. 80 of these overtime hours were to fulfill a customer order that had originally been planned for manufacture next month. The sales manager had agreed to bring forward the delivery of this order at the request of the customer. The remaining overtime hours were due to unexpected inefficiency of the workforce; this has been traced to poor supervision by a junior manager.

Material costs included the following:

$5,300 of material A. Material A is a commodity and, due to changes on the global market, the actual unit cost of this material for last month was 6% higher than had been expected

$5,250 of material B. The usage of material B last month was 5% higher than it should have been due to faulty workmanship on the production line.

What is the total value of the above costs that was controllable by the production manager?