Question 151

Which of the following would MOST LIKELY cause a decrease in a company's deposited checks availability?

Question 152

XYZ Inc. has limited cash flow, total liabilities to total assets greater than 52%, and a high WACC.

To help meet the goal of lowering their WACC, the company plans to issue several million dollars of private equity to the chairman of the board. If the company proceeds with this plan, the company may:

To help meet the goal of lowering their WACC, the company plans to issue several million dollars of private equity to the chairman of the board. If the company proceeds with this plan, the company may:

Question 153

A small import/export company, XYZ Company, has recently set up an account with a German firm. The contract between the companies states that XYZ is to be paid as soon as all documents are in order showing that the transaction terms have been met. Which of the following forms of payment drafts would be MOST appropriate for XYZ?

Question 154

Which of the following capital budgeting methods ignores the time value of money?

Question 155

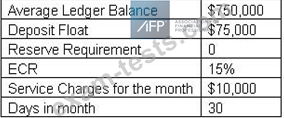

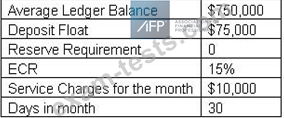

ABL Corporation is currently receiving a return of 10% on its investments. The bank is offering them an ECR of 15%. In order to get more value for their money ABL Corp. has decided to take advantage of the higher ECR and use funds from its Money Market Accounts to cover bank service charges.

If ABL already has an average ledger balance of $750,000, how much more do they need to deposit on their account to cover all $10,000 of monthly service charges?

If ABL already has an average ledger balance of $750,000, how much more do they need to deposit on their account to cover all $10,000 of monthly service charges?