Question 156

A company in the market to purchase a treasury management system (TMS) has issued a request for proposal to evaluate various vendors. One of the evaluation factors focuses on the long-term viability of the vendor. The company may have to choose between an untested new vendor with a superior product and an established vendor with an incomplete product suite. This dimension of the RFP is measuring what type of risk?

Question 157

Company ABC is experiencing an increase in bank fees due to its new international customers paying by check. Nearly 15% of all deposited items are international checks. Twenty percent of the company's checks have 1 day of float. Sixty-five percent of the company's checks are on-us items. The company has $300,000 of deposits each day. The company's deposits consist of both cash and checks, split evenly. On a typical day, how much of the deposit will be available immediately?

Question 158

The MICR encoding on a check provides all of the following information EXCEPT:

Question 159

When a company announces a significant and unexpected dividend increase, it signals to the market that management expects:

Question 160

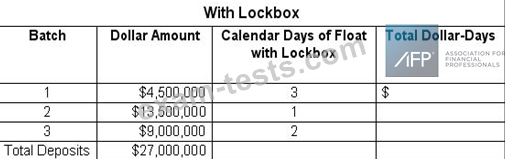

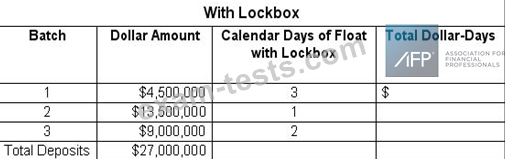

An analyst at XYZ Company was assigned with determining if the company should start to use a lockbox provider for its retail payments. The analyst determined that the company's annual sales of $324,000,000 were recorded evenly throughout the year. The Company receives 30,000 checks annually. Total dollar-days float without the lockbox is $76,500,000 and the annual opportunity cost is 5.5%; assume 30-day month. The industry's average opportunity cost is 6.0%. Using the information in the table,

what would be the net effect of using the lockbox?

what would be the net effect of using the lockbox?