Question 181

Which of the following objectives of treasury management refers to a company's ability to meet current and future financial obligations in a timely, efficient, and cost-effective manner?

Question 182

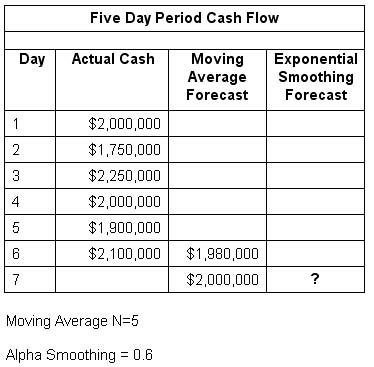

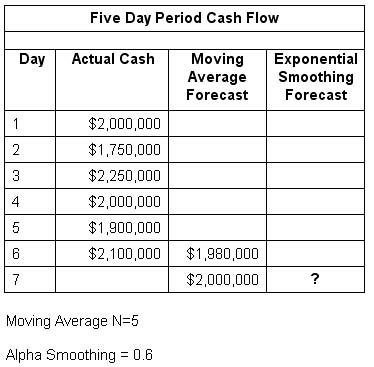

QRT Corporation uses exponential smoothing in its cash flow forecasting model. Five days are used to calculate the moving average forecast.

If the value of the smoothing constant is .60, what is the exponential smoothing forecast for day 7?

If the value of the smoothing constant is .60, what is the exponential smoothing forecast for day 7?

Question 183

In a maturity matching financing strategy, which of the following is financed using short-term sources?

Question 184

XYZ Company is considering different methods of concentrating cash from its subsidiary accounts to its main operating account. It uses short-term borrowings with a rate of 7% to fund daily operations, and the reserve adjusted earnings credit rate on its subsidiary accounts is 1%. A review of its bank fees shows that wires (same day transfer) cost the XYZ Co. $7.00 each while ACH debits (next day transfer) cost $1.25 each. If the primary objective is to minimize costs, what must the transfer amount be (rounded to the nearest whole $) to justify the use of a wire transfer instead of an ACH to concentrate the funds?

Question 185

A treasurer decides to use notional pooling across wholly-owned multiple legal entities instead of wiring money between entity accounts. What specific section in the company's policy allowed the treasurer to make this decision?