Question 116

Section B (2 Mark)

Which of the following are the objectives of National Housing Bank in Indian Real Estate Market?

Which of the following are the objectives of National Housing Bank in Indian Real Estate Market?

Question 117

Section B (2 Mark)

The risk-free return is 9 percent and the expected return on a market portfolio is 12 percent. If the required return on a stock is 14 percent, what is its beta?

The risk-free return is 9 percent and the expected return on a market portfolio is 12 percent. If the required return on a stock is 14 percent, what is its beta?

Question 118

Section A (1 Mark)

A well-diversified portfolio is defined as

A well-diversified portfolio is defined as

Question 119

Section C (4 Mark)

Read the senario and answer to the question.

You have reviewed the investments of Nimita for the purview of retirement. You advise that a balance be restored from risk perspective and accordingly Rs. 15 lakh be shifted to a Debt MF scheme. You advise to further start SIPs immediately in the ratio of 60:40 in the newly started debt MF scheme and the existing Equity MF scheme for the next 21 years to accumulate a corpus so that the same sustains for the next 25 years if invested in an investment instrument yielding 7.50%. What approximate amount of SIPs should be made in Debt and Equity MF schemes?

Read the senario and answer to the question.

You have reviewed the investments of Nimita for the purview of retirement. You advise that a balance be restored from risk perspective and accordingly Rs. 15 lakh be shifted to a Debt MF scheme. You advise to further start SIPs immediately in the ratio of 60:40 in the newly started debt MF scheme and the existing Equity MF scheme for the next 21 years to accumulate a corpus so that the same sustains for the next 25 years if invested in an investment instrument yielding 7.50%. What approximate amount of SIPs should be made in Debt and Equity MF schemes?

Question 120

Section B (2 Mark)

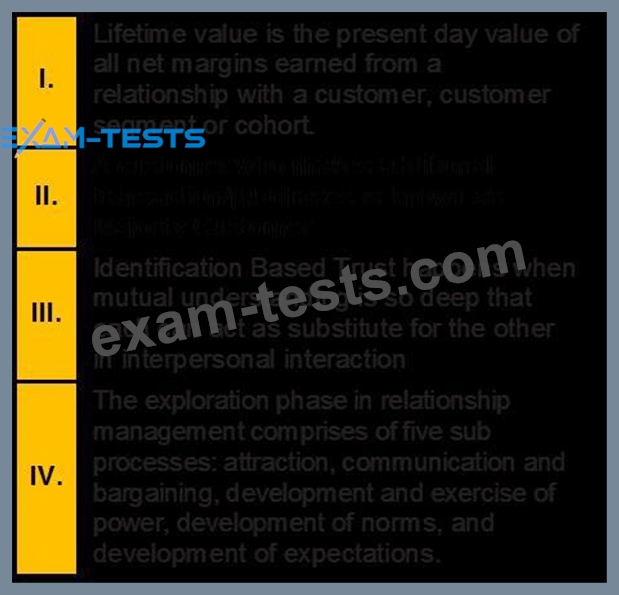

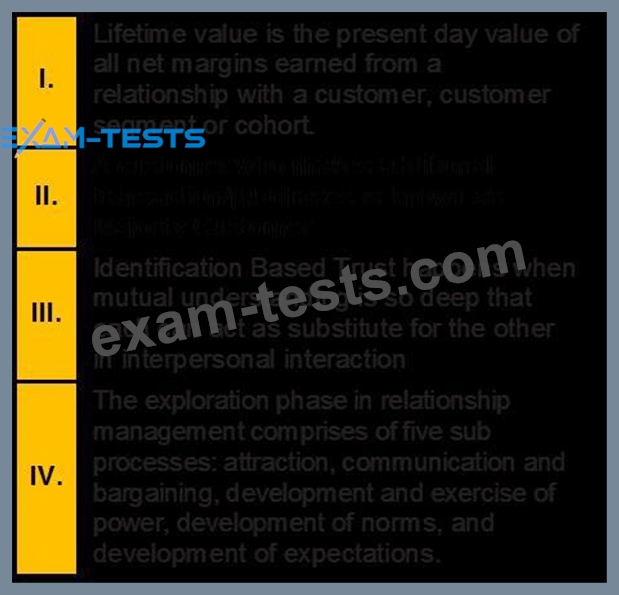

Which of the following statements is/are correct?

Which of the following statements is/are correct?