Question 131

Section C (4 Mark)

You purchased a call option for Rs3.45 seventeen days ago. The call has a strike price of Rs45 and the stock is now trading for Rs51. If you exercise the call today, what will be your holding period return? If you do not exercise the call today and it expires, what will be your holding period return?

You purchased a call option for Rs3.45 seventeen days ago. The call has a strike price of Rs45 and the stock is now trading for Rs51. If you exercise the call today, what will be your holding period return? If you do not exercise the call today and it expires, what will be your holding period return?

Question 132

Section A (1 Mark)

The bank's real estate loan officer should consider which of the following aspects of the customer's loan application carefully when making a home mortgage?

The bank's real estate loan officer should consider which of the following aspects of the customer's loan application carefully when making a home mortgage?

Question 133

Section A (1 Mark)

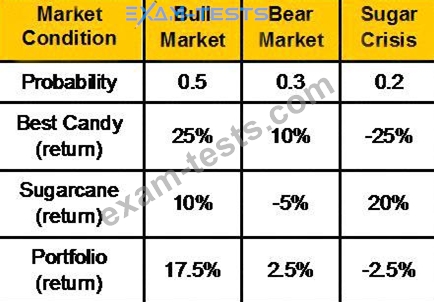

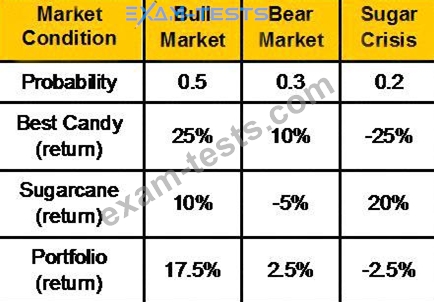

Given below is the portfolio return; calculate the expected portfolio rate of return:

Given below is the portfolio return; calculate the expected portfolio rate of return:

Question 134

Section B (2 Mark)

On 1st February 2009, Mr. Dutt took a personal loan of Rs. 1,00,000 for a period of 3 years at an 21% rate of interest .The loan is to be on monthly EMI on monthly reducing balance method.

What would be interest and principal amount to be paid in November 2011?

On 1st February 2009, Mr. Dutt took a personal loan of Rs. 1,00,000 for a period of 3 years at an 21% rate of interest .The loan is to be on monthly EMI on monthly reducing balance method.

What would be interest and principal amount to be paid in November 2011?

Question 135

Section C (4 Mark)

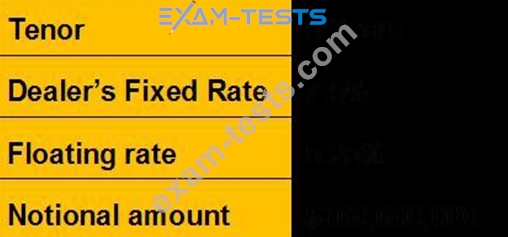

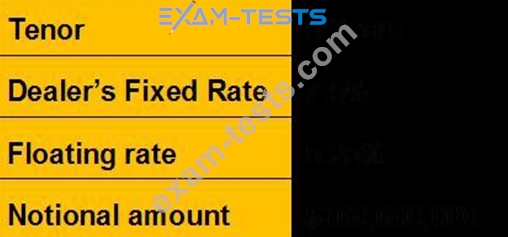

Assume the following;

With this agreement, every 6 months, the transfer of funds takes place between fixed rate payer and floating rate payer.

What would Net Cash flows after 6-months from the initiation date?

Assume the following;

With this agreement, every 6 months, the transfer of funds takes place between fixed rate payer and floating rate payer.

What would Net Cash flows after 6-months from the initiation date?