Question 6

XY owned 60% of the equity share capital of AB at 1 January 20X6. XY acquired a further 20% of AB's equity share capital on 31 December 20X6 for $500,000. The non controlling interest in AB was measured at $720,000 immediately prior to the 20% acquisition.

Calculate the amount that XY debited to non controlling interest when it accounted for the 20% acquisition in its consolidated financial statements at 31 December 20X6.

Give your answer to the nearest $000.

$ ? 000

Calculate the amount that XY debited to non controlling interest when it accounted for the 20% acquisition in its consolidated financial statements at 31 December 20X6.

Give your answer to the nearest $000.

$ ? 000

Question 7

Which TWO of the following are true in relation to IAS21 The Effects of Changes in Foreign Exchange Rates when consolidating an overseas subsidiary?

Question 8

BC are currently seeking to establish an accounting policy for a particular type of transaction.

There are four alternative ways in which this transaction can be treated. Each treatment will have a different outcome on the financial statements as follows:

* Treatment one means that the financial statements will be easier to prepare.

* Treatment two will give a fair representation of the transaction in the financial statements.

* Treatment three will maximise the profit figure presented in the financial statements.

* Treatment four means that the financial statements will be more easily understood by shareholders.

Which accounting treatment should BC adopt?

There are four alternative ways in which this transaction can be treated. Each treatment will have a different outcome on the financial statements as follows:

* Treatment one means that the financial statements will be easier to prepare.

* Treatment two will give a fair representation of the transaction in the financial statements.

* Treatment three will maximise the profit figure presented in the financial statements.

* Treatment four means that the financial statements will be more easily understood by shareholders.

Which accounting treatment should BC adopt?

Question 9

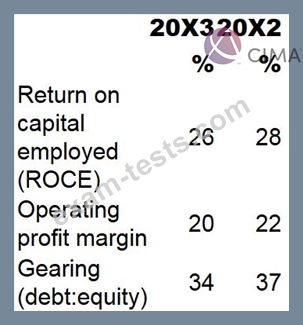

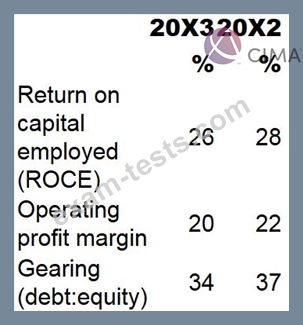

Ratios have been produced below for EF for the year to 31 March:

Which TWO of the following could explain the movement in both gearing and ROCE?

Which TWO of the following could explain the movement in both gearing and ROCE?

Question 10

EFG is preparing its financial statements to 31 March 20X8. During the year ended 31 March 20X7, EFG purchased a piece of land for $1 million which is used as the staff car park. EFG has a policy of revaluing land, in accordance with International Accounting Standards, and at 31 March 20X8, accounted for a substantial increase in its value.

Revenue and operating profit has remained constant over the 2 years.

When comparing EFG's financial statements for the year ended 31 March 20X7 with those of 20X8, which THREE of the following would be expected?

Revenue and operating profit has remained constant over the 2 years.

When comparing EFG's financial statements for the year ended 31 March 20X7 with those of 20X8, which THREE of the following would be expected?