Question 66

CD acquired 100% of the equity share capital of FG for cash consideration of Kr1,200,000 on 1 January

20X7.

Retained earnings of FG at the date of acquisition was Kr800,000. CD operates from Country A and its functional and presentation currency is $. FG is located and trades throughout Country B and its functional currency is the Krona (Kr).

CD has no other subsidiaries. Goodwill had not suffered any impairment to date.

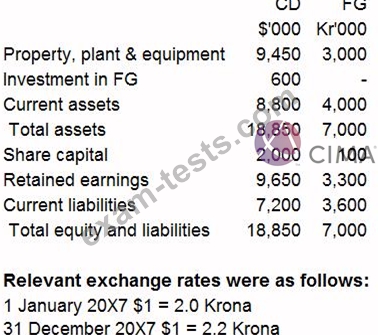

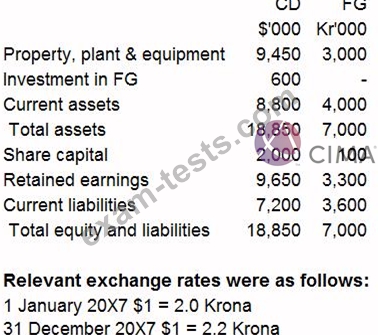

Summarised data from the statements of financial position for both entities at 31 December 20X7 is presented below:

Which of the following is the correct application of IAS 21 The Effects of Changes in Foreign Exchange Rates in translating FG's statement of financial position into the presentation currency of CD for consolidation purposes at 31 December 20X7?

20X7.

Retained earnings of FG at the date of acquisition was Kr800,000. CD operates from Country A and its functional and presentation currency is $. FG is located and trades throughout Country B and its functional currency is the Krona (Kr).

CD has no other subsidiaries. Goodwill had not suffered any impairment to date.

Summarised data from the statements of financial position for both entities at 31 December 20X7 is presented below:

Which of the following is the correct application of IAS 21 The Effects of Changes in Foreign Exchange Rates in translating FG's statement of financial position into the presentation currency of CD for consolidation purposes at 31 December 20X7?

Question 67

Which of the following examples would be classed as related parties ofJH Ltd due to the power they possess to directly influence the company?

1: JH Ltd's managing director

2: The son of JH Ltd's managing director, who is an intern in the company's office

3: The brother of JH Ltd's managing director, whose business supplies a large amount of production material for the company

4: JH Ltd's subsidiary company, AL Ltd

5: BR PLC, one of JH Ltd's regular customers

1: JH Ltd's managing director

2: The son of JH Ltd's managing director, who is an intern in the company's office

3: The brother of JH Ltd's managing director, whose business supplies a large amount of production material for the company

4: JH Ltd's subsidiary company, AL Ltd

5: BR PLC, one of JH Ltd's regular customers

Question 68

What is the total comprehensive income attributable to the non-controlling interest that will be presented in GHI's consolidated statement of changes in equity for the year ended 31 December 20X4?

Question 69

Which THREE of the following actions should improve the cash position of an entity?

Question 70

LM is a car dealer that is supplied inventory by car manufacturer SQ. Trading between LM and SQ is subject to a contractual agreement. This agreement states the following:

* Legal title of the cars remains with SQ until they are sold by LM to a third party.

* Upon notification of sale to a third party by LM, SQ raises an invoice at the price agreed at the original date of delivery to LM.

* LM has the right to return any car at any time without incurring a penalty.

* LM is responsible for insuring all of the cars on its property.

When considering how these cars should be accounted for, which THREE of the following statements are true?

* Legal title of the cars remains with SQ until they are sold by LM to a third party.

* Upon notification of sale to a third party by LM, SQ raises an invoice at the price agreed at the original date of delivery to LM.

* LM has the right to return any car at any time without incurring a penalty.

* LM is responsible for insuring all of the cars on its property.

When considering how these cars should be accounted for, which THREE of the following statements are true?