Question 341

You are considering investing in following bond:

Your income tax rate is 34 percent and your capital gains tax is effectively 10 percent. Capital gains taxes are paid at the time of maturity on the difference between the purchase price and par value. What is your approximate post-tax yield to maturity on this bond?

Your income tax rate is 34 percent and your capital gains tax is effectively 10 percent. Capital gains taxes are paid at the time of maturity on the difference between the purchase price and par value. What is your approximate post-tax yield to maturity on this bond?

Question 342

Which of the following statement (s) is/are true about the rate risk?

Question 343

As per rule 69 of doubling, what is the doubling period if rate of interest is 9%

Question 344

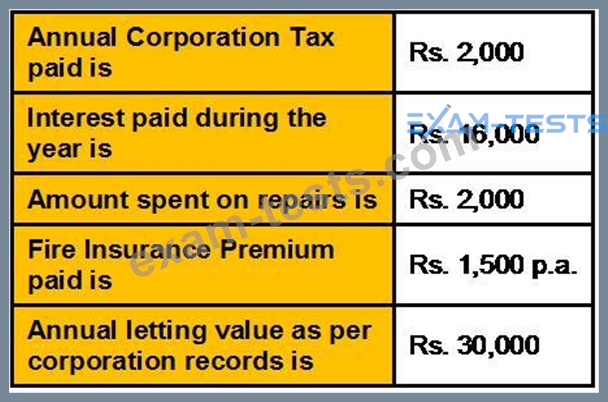

Which of the following is allowed as deduction from net annual value of a property?

Question 345

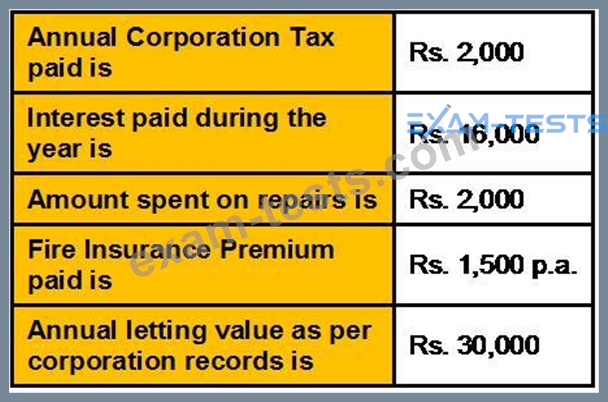

Mr. Pradip completed construction of a residential house on 1.4.2011.

Interest paid on loans borrowed for purpose of construction during the 2 years prior to completion was Rs.

40,000. The house was let-out on a monthly rent of Rs. 4,000.

Property was vacant for 3 months.

Compute the income under the head "Income from House Property" for the A.Y. 2012-13.

Interest paid on loans borrowed for purpose of construction during the 2 years prior to completion was Rs.

40,000. The house was let-out on a monthly rent of Rs. 4,000.

Property was vacant for 3 months.

Compute the income under the head "Income from House Property" for the A.Y. 2012-13.