Question 41

Deduction under section 80QQB is allowed to an author of a book of literary or artistic or scientific nature who is resident in India to the extent of:

Question 42

If a stock GHI ltd pays an annual dividend of Rs. 5 and plans to follow this policy for ever, then what would be the ate of return that investor would realize given the current market price of stock is 100

Question 43

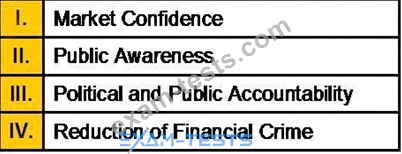

Which of the following is/are not the statutory objectives of Financial Service Authority(FSA) of UK?

Question 44

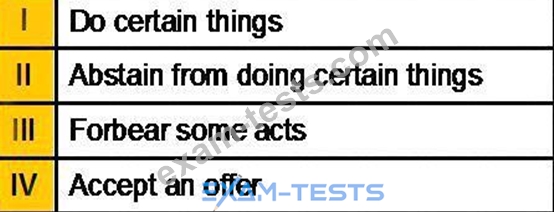

Consideration' under the law is a return promise to:

Question 45

............... mortgage is an extremely good resource for retirement planning.