Question 46

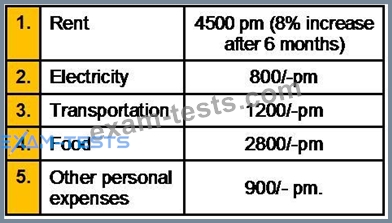

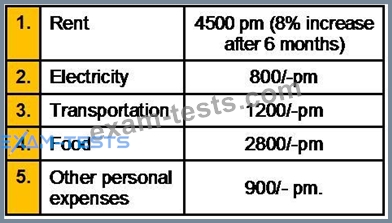

Suresh a 30 years old person has joined ABHG on 1/07/2006. His monthly salary (net salary) after deduction is payable Rs. 20500.His monthly expenses details are as follows:

Assume that Suresh has taken his flat on rent from 01/07/2006. On 01 /07/2006 he has cash in hand Rs. 2450.

What will be his cash in hand on 31/03/2007.

Assume that Suresh has taken his flat on rent from 01/07/2006. On 01 /07/2006 he has cash in hand Rs. 2450.

What will be his cash in hand on 31/03/2007.

Question 47

Stock broker's human capital is _________ to stock market as compared to a school teacher

Question 48

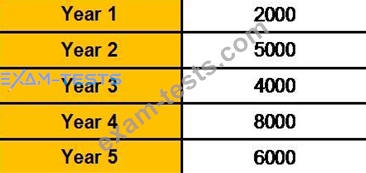

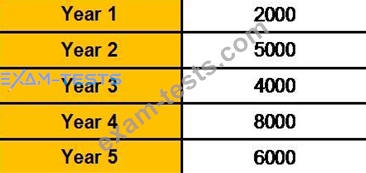

An investment required an initial cash outlay of Rs. 15,000/- and yield cash flows over the next 5 years. The cash flows generated are:

You are required to calculate the payback period:

You are required to calculate the payback period:

Question 49

Vikrant Juneja gifted his house property to his wife in year 2007. Mrs. Juneja then lets out this house @ Rs.

5000 per month. The income from such house property will be taxable in the hands of:

5000 per month. The income from such house property will be taxable in the hands of:

Question 50

In which year can the subscriber to a PPF account take the first loan from the opening of the account?