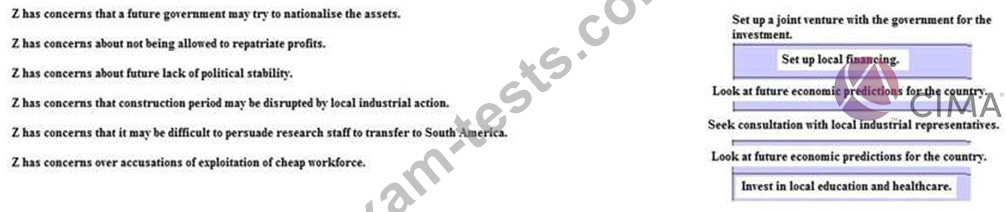

Question 51

Z is a multinational pharmaceuticals company with operations across Europe, America and Asia.

It is currently investigating the possibility of setting up a chemical and specialist production facility in South America. This would be a multi $billion investment. What steps should Z take to manage the following risks in this long term venture.

It is currently investigating the possibility of setting up a chemical and specialist production facility in South America. This would be a multi $billion investment. What steps should Z take to manage the following risks in this long term venture.

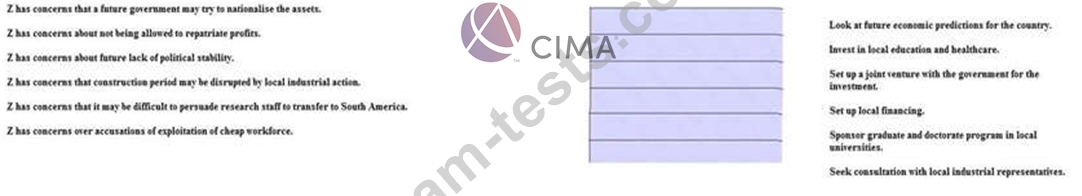

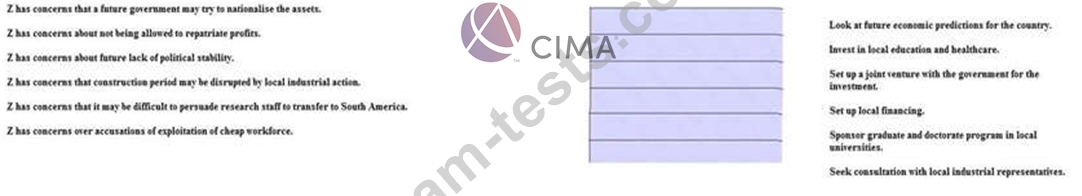

Question 52

Z is a multinational pharmaceuticals company with operations across Europe, America and Asia.

It is currently investigating the possibility of setting up a chemical and specialist production facility in South America. This would be a multi $billion investment. What steps should Z take to manage the following risks in this long term venture.

It is currently investigating the possibility of setting up a chemical and specialist production facility in South America. This would be a multi $billion investment. What steps should Z take to manage the following risks in this long term venture.

Question 53

A UK manufacturing company has simultaneously:

* purchased a put option to sell USD 1million at an exercise price of GBP1.00 = USD1.65

* sold a call option that grants the option holder the right to buy USD 1million at a price of GBP1.00 = USD1.61 (this option has the same maturity date as the put).

Which of the following is a valid explanation for entering into these option positions?

* purchased a put option to sell USD 1million at an exercise price of GBP1.00 = USD1.65

* sold a call option that grants the option holder the right to buy USD 1million at a price of GBP1.00 = USD1.61 (this option has the same maturity date as the put).

Which of the following is a valid explanation for entering into these option positions?

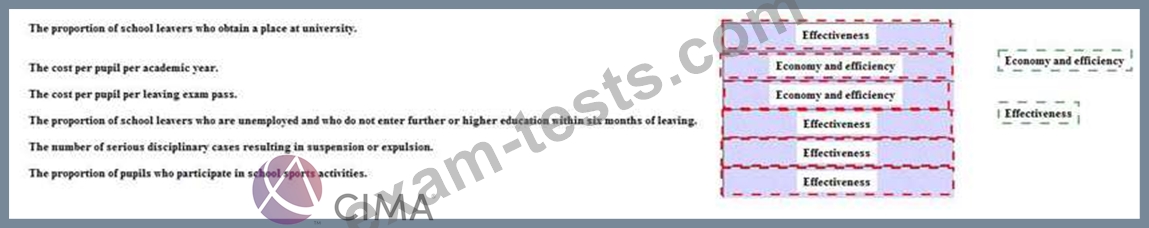

Question 54

A government department is conducting a value for money audit on a school.

The school's pupils sit leaving exams. Classify each of the audit tests as either economy and efficiency or effectiveness.

The school's pupils sit leaving exams. Classify each of the audit tests as either economy and efficiency or effectiveness.

Question 55

M plc has a $2 million loan outstanding on which the interest rate is reset every 6 months for the following 6 months and the interest is payable at the end of that 6-month period. The next 6-monthly reset period starts in

3 months and the treasurer of M plc thinks that interest rates are likely to rise between now and then.

Current 6-month rates are 7.2% and the treasurer can get a rate of 7.7% for a 6-month forward rate agreement (FRA) starting in 3 months' time. By transacting an FRA the treasurer can lock in a rate today of 7.7%.

If interest rates are 8.5% in 3 months' time, what will the net amount payable be?

Give your answer to the nearest thousand dollars.

3 months and the treasurer of M plc thinks that interest rates are likely to rise between now and then.

Current 6-month rates are 7.2% and the treasurer can get a rate of 7.7% for a 6-month forward rate agreement (FRA) starting in 3 months' time. By transacting an FRA the treasurer can lock in a rate today of 7.7%.

If interest rates are 8.5% in 3 months' time, what will the net amount payable be?

Give your answer to the nearest thousand dollars.