Question 91

Banks duration match their assets and liabilities to manage their interest risk in their banking book. A bank has

$100 million in interest rate sensitive assets and $100 million in interest rate sensitive liabilities. Currently the

bank's assets have a duration of 5 and its liabilities have a duration of 2. The asset-liability management

committee of the bank is in the process of duration-matching. Which of the following actions would best

match the durations?

$100 million in interest rate sensitive assets and $100 million in interest rate sensitive liabilities. Currently the

bank's assets have a duration of 5 and its liabilities have a duration of 2. The asset-liability management

committee of the bank is in the process of duration-matching. Which of the following actions would best

match the durations?

Question 92

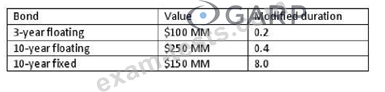

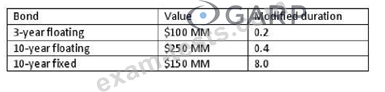

A portfolio consists of two floating rate bonds and one fixed rate bond.

Based on the information below, modified duration of this portfolio is

Based on the information below, modified duration of this portfolio is

Question 93

Which one of the four following activities is NOT a component of the daily VaR computing process?

Question 94

Which of the following factors would typically increase the credit spread?

I. Increase in the probability of default of the issuer.

II. Decrease in risk premium.

III. Decrease in loss given default of the issuer.

IV. Increase in expected loss.

I. Increase in the probability of default of the issuer.

II. Decrease in risk premium.

III. Decrease in loss given default of the issuer.

IV. Increase in expected loss.

Question 95

Which one of the following four statements correctly describes an American call option?